A droopy U.S. dollar was at or near seven-week lows a day after the Federal Reserve raised rates and signaled borrowing rates were close to peak levels. The greenback slipped toward two-week lows versus the Canadian dollar, while it fell to six- and seven-week lows against the euro and sterling, respectively. The Fed Wednesday delivered a ninth consecutive rate hike that boosted its benchmark rate by 25 basis points to roughly 4.9%, the highest level since 2007. Fed Chair Powell acknowledged that the central bank considered pausing rate increases this week given turmoil in the banking sector. The Fed’s statement that accompanied its policy decision struck a dovish note as it dropped a phrase that vowed “ongoing increases” to borrowing rates and replaced it by indicating that “some additional policy firming may be appropriate.” The Fed’s table now may only have one rate hike on the table instead of multiple which damaged the dollar’s allure. Moreover, the Fed and markets appear to be moving out of sync on the trajectory for interest rates, with the former signaling a high bar to cuts with the latter implying a lower bar to policy easing, a dollar-negative theme that was prevalent earlier this year.

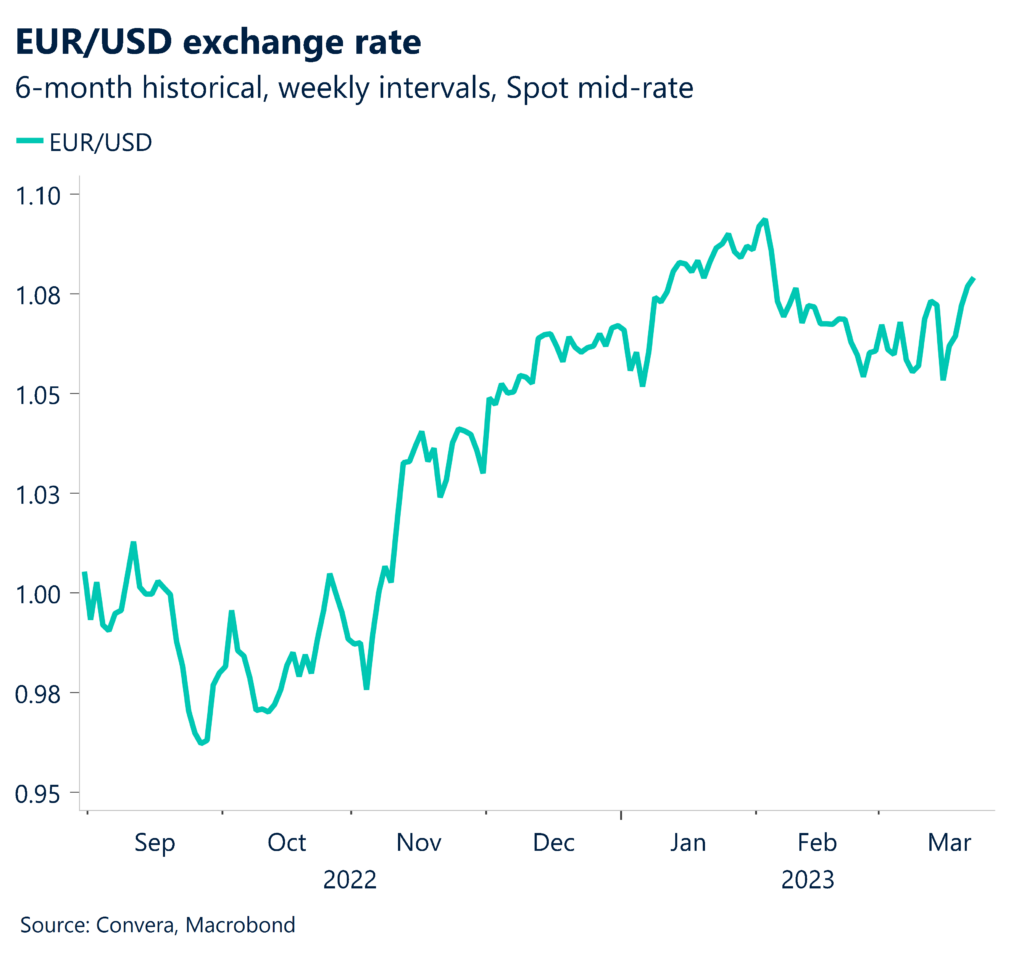

The euro rose to its highest level in nearly seven weeks against the greenback after the Fed signaled U.S. interest rates were close to peaking, a dovish view that contrasts expectations of ongoing rate hikes by the ECB. As a result, the euro is taking a page out of its early year playbook when it raced higher against the greenback on the view that the ECB would tightening monetary policy more aggressively than Washington over the course of 2023. Much uncertainty remains, however. Should America’s banking sector woes calm in a meaningful way and fade while U.S. inflation remains elevated, the Fed might have to put more dollar-positive rate hikes back on the table.

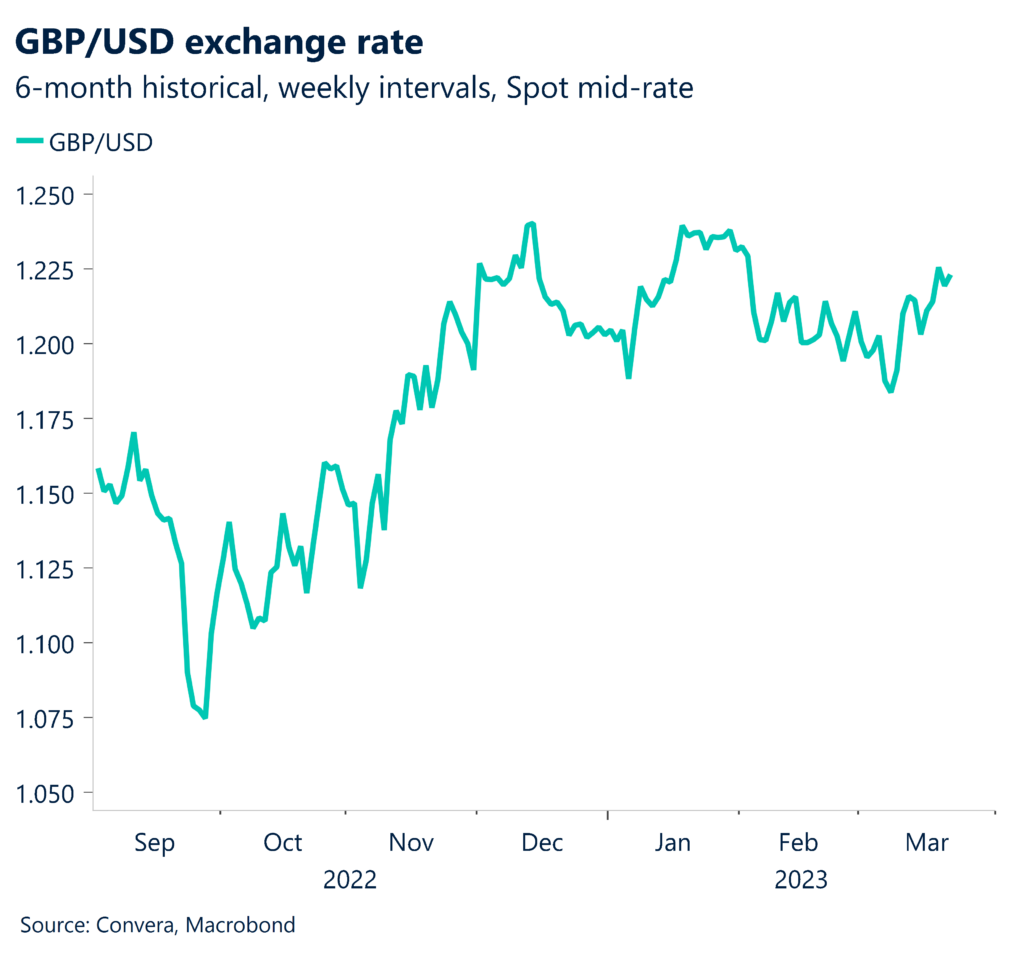

Sterling popped to seven-week highs as the Bank of England delivered an 11th straight rate hike, a quarter-point increase to 4.25%, the juiciest level in 14 years. The BOE vowed further rate hikes if inflation remains stubbornly elevated. The pound earlier this week jumped in response to a surprise acceleration in UK consumer inflation to 10.4% in February, compared to expectations of a move into the single digits. The 9 members of the UK’s rate-setting team voted 7-2 in favor of today’s move with the two dissenters preferring to hold rates at 4%. Inflation holds the biggest key to the policy outlook and officials expect prices to “fall sharply” over the balance of the year.

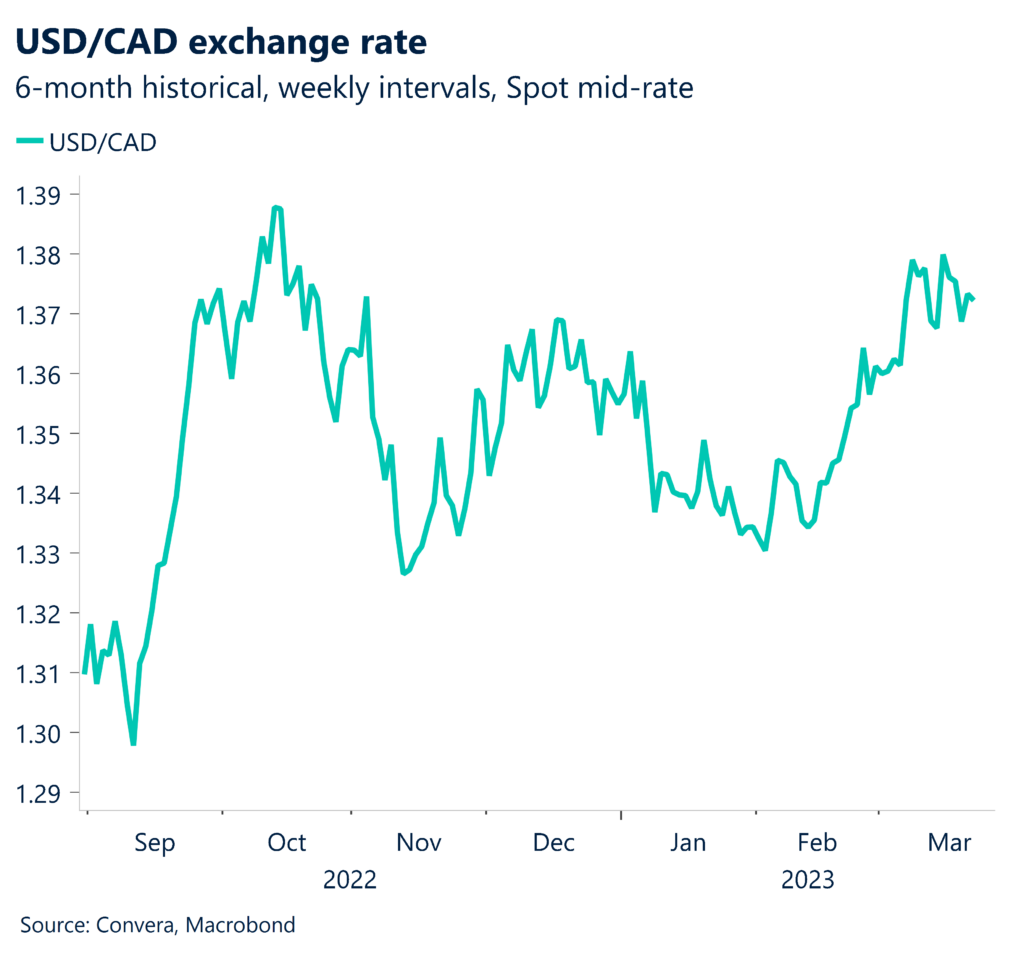

The Canadian dollar rose toward recent two-week peaks against the greenback as stock markets rebounded from a Fed-induced fall the previous day. Improved risk sentiment buoyed the commodity trio of currencies from Canada, Australia and New Zealand. The perception that the Fed may be all but done raising U.S. borrowing rates helps to narrow loonie-negative policy divergence that has served as a recent headwind on the Canadian unit.

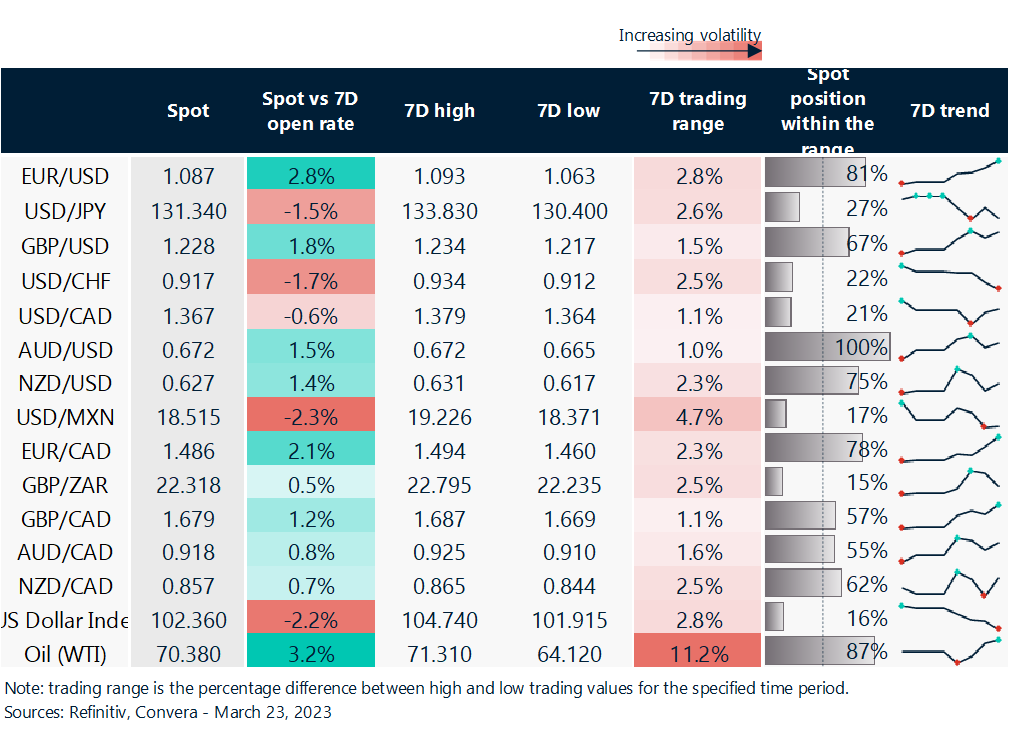

Dollar slumps toward bottom of ranges

Table: rolling 7-day currency trends and trading ranges

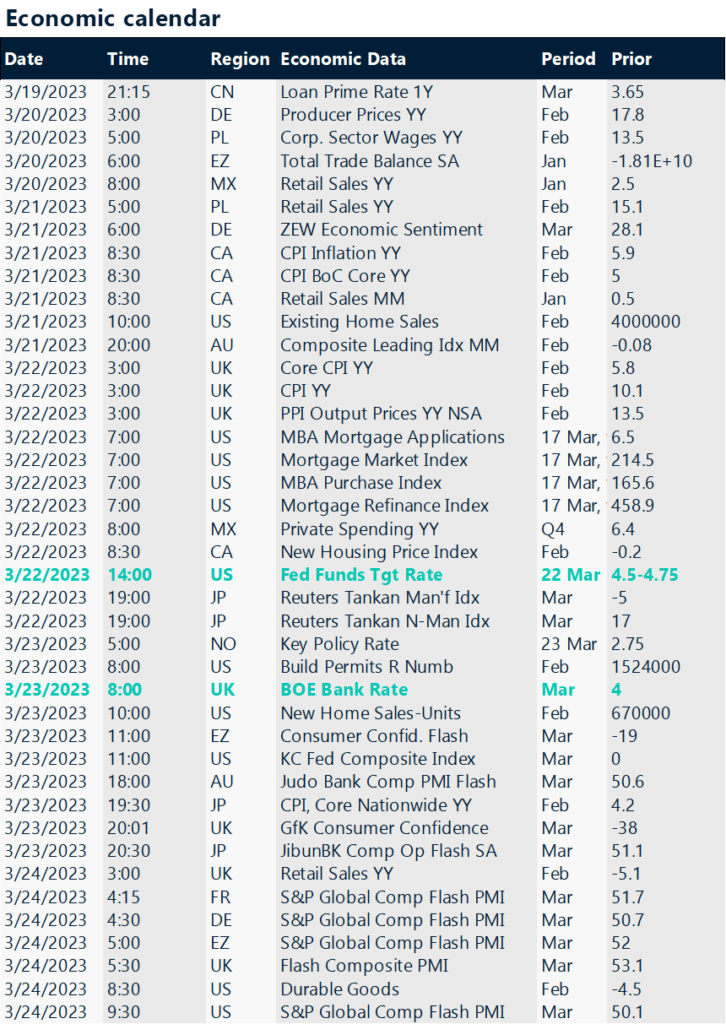

Key global risk events

Calendar: Mar 20-24

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.