Written by Convera’s Market Insights team

Dollar rally stalls

George Vessey – Lead FX Strategist

A quiet start to the last week of June, saw US equities in mixed territory, bonds flat and the US dollar’s recent rally taking a pause. The dollar index pulled back from over 2-month highs, whilst the Swiss franc also came under selling pressure in a sign of renewed, but modest, risk appetite across the FX space. US consumer confidence is in focus later today.

Over recent weeks, the US dollar has emerged as the favourite hedge for political uncertainty in the wake of the snap French election being called and subsequently elevated European bond market volatility. This was especially the case given gains in Europe’s natural safe-haven – the Swiss franc – being hindered by the dovish Swiss National Bank, which cut interest rates last week for a second time this year. Conversely, the US Federal Reserve (Fed) has signalled to deliver just one rate cut this year, whilst markets are pricing in almost two, with over a 60% probability of a move in September. This Fed hawkishness has also supported dollar demand over recent weeks. However, market participants now brace for comments from several Fed officials and incoming data to continue assessing the monetary policy outlook. The Fed’s preferred inflation gauge, the core PCE deflator, which is expected to print at its slowest monthly pace this year, is the highlight at the end of the week.

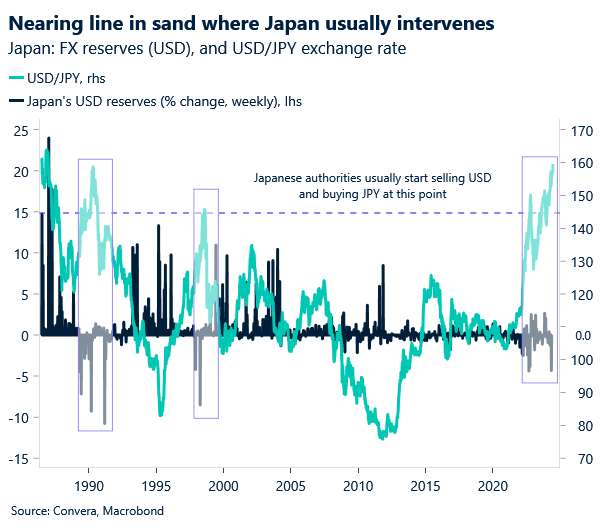

As such, short-term downside risk to the US dollar may rise if the core PCE data comes in line or falls below expectations. Still, given the elevated European risk premium ahead of the French vote on Sunday, upside for European currencies versus the US currency could be limited. USD/JPY, on the other hand, is a key currency pair in the spotlight with the risk of hefty price swings increasing as we linger near the ¥160 handle.

CAD holds firm ahead of CPI

Ruta Prieskienyte – Lead FX Strategist

The Canadian dollar edged higher along with most G10 peers amid renewed risk sentiment, touching a fresh 3-week high. The attention now turns to the domestic CPI report due shortly today. Markets expect the headline rate to trend lower to 2.6% y/y, along with the core inflation metrics.

Today’s print will be the second biggest data release since the Bank of Canada cut its policy rates on June 5th. Earlier this month the jobs print showed a marked slowdown in hiring in May along with the unemployment rate ticking higher. As the tight monetary policy continues to bite the pressure builds on the BoC to resume with its easing cycle. The overnight index swaps are currently pricing in 62% probability of a back-to-back policy rate cut in July along with cumulative 54bps of easing by year end.

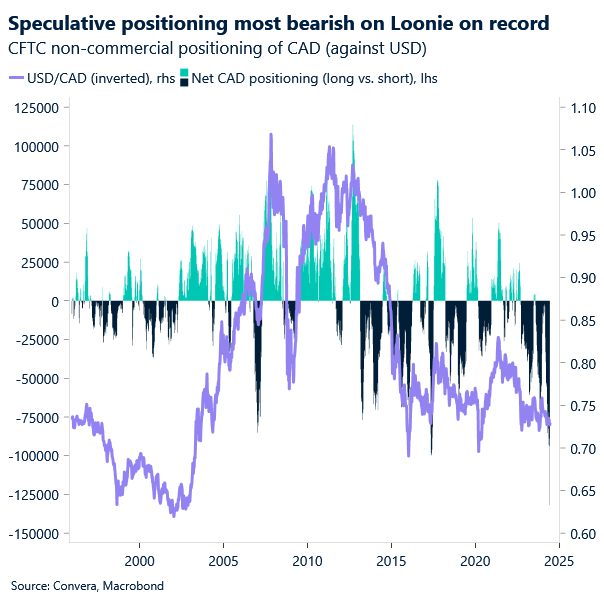

The Canadian dollar has been trading gradually stronger, crawling back around 1% in the spot market, since the recent trough on June 11th largely on the back of generally supportive sentiment, higher oil prices and distance from the EU political turmoil. In the options market, the short-term market sentiment remains CAD bearish, admittedly at the least negative, over the near-term horizon. This is understandable, given that the BoC is expected to cut an additional three times versus Fed’s one-two. In fact, the latest positioning data shows that the asset managers also turned the most bearish on the Canadian dollar in records going back to 2006, which is expected to continue to heavily weigh on the Loonie.

Pound holds steady after CBI survey

George Vessey – Lead FX Strategist

Thanks to a broadly softer US dollar and an upbeat UK business survey, GBP/USD is stretching back towards $1.27 after rebounding off its 50- and 100-day moving averages. The pair remains caught in a short-term descending trend channel for the month though. Meanwhile, GBP/EUR continues to defy real rate differentials and is holding above €1.18 for the longest stint since 2022.

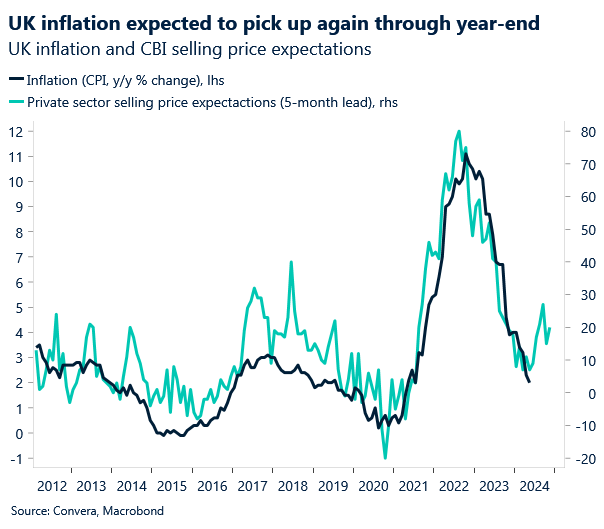

UK manufacturers remain confident the economy is heading in the right direction as evidenced by the Confederation of British Industry (CBI) June survey that showed total order book balance in the UK rose to -18, the highest in three months and above market expectations of -25. However, the level of order books remained slightly below the long-run average (-13%). Expectations for output rose to their highest level since October, whilst expectations for average selling price inflation accelerated in June (+20%, from +15% in May) – well above the long-run average (+7%). We view this data as a strong leading indicator for UK inflation and therefore support the notion of renewed price pressures emerging through year-end, challenging the Bank of England’s (BoE) monetary easing outlook.

However, given economic momentum is slowing, as per the weaker-than-expected flash PMIs last Friday, and the fact the unemployment rate rose to 4.4% in April, reaching its highest level since September 2021, we still lean towards the BoE cutting rates by 25 basis points in August. This presents a downside risk to the pound given markets are pricing in around -17 basis points.

Euro gains after two-day slump

Ruta Prieskienyte – Lead FX Strategist

The markets reopened for the final trading week of the quarter with renewed risk appetite. The euro bounced back from its lower Bollinger band to post the first daily advance against the US dollar over the past three trading sessions, edging closer to the key $1.0750 threshold, which it had not been able to confidently clear since the announcement of the snap election in France. European stocks gained while government bond yields trended broadly lower.

On the data front, the latest Ifo German business survey revealed an unexpected drop in business morale in June, the first such decline in five months. The expectations gauge fell to 89 from 90.4 in the previous month, while the current outlook remained steady at 88.3. The reading showed sentiment has deteriorated at companies, and the German economy continues to face headwinds in overcoming stagnation. The weaker sentiment adds some downside risk; however, we continue to expect growth to pick up slightly in the coming quarters. Not all was gloomy, as the outlook in the services sector for the second half of the year continued to brighten. Sentiment improved especially in the hotel sector, unsurprisingly given that the Euro 2024 final will be held in Berlin in mid-July.

Elsewhere, the latest Ifop-Fiducial poll of voting intentions published late Sunday revealed that Marine Le Pen’s far-right National Rally would win the first round of the French legislative election with 35.5%, up 0.5 points since the previous survey, while President Emmanuel Macron’s group would get 21%, down 0.5 points. Bond markets remain agitated, with the OAT-Bund yield spread easing only fractionally to 76bps (-4bps).

With today’s economic calendar bare, the direction in currency markets will be in the hands of US-centric developments. Domestically, ECB’s Stournaras and Nagel are scheduled to speak, but we do not anticipate either of the policymakers providing a clearer picture of future policy trajectory. Such a policy stance was once again highlighted by ECB’s Schnabel, who noted that the potential of shocks prevents the central bank from precommitting to a specific path on rates, further underscoring the central bank’s data-dependent stance. As it stands, the overnight index swap implied cuts stand at 43bps of additional easing by year-end versus the Fed’s 47bps with markets anticipating the next ECB cut in September with 65% conviction.

Low yielders yen and franc remain pressured

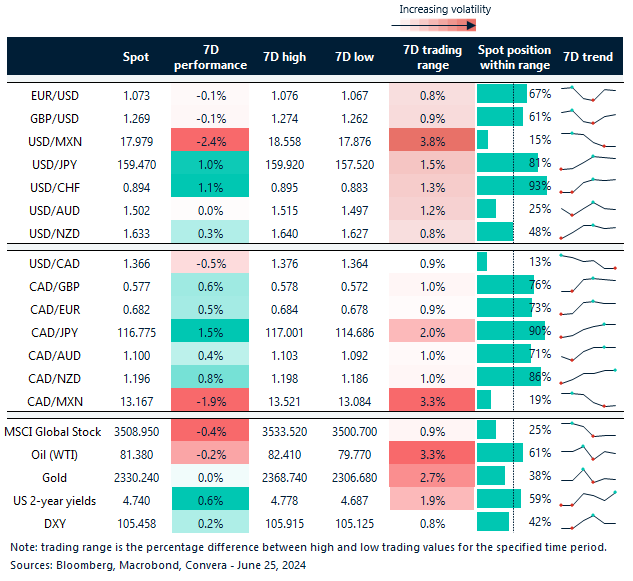

Table: 7-day currency trends and trading ranges

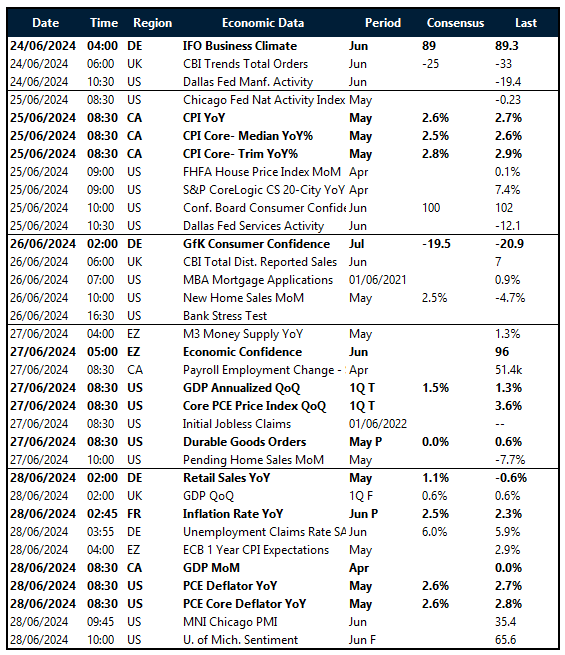

Key global risk events

Calendar: June 24-28

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.