Global overview

The U.S. dollar was mostly steady to kick off the final week of the first quarter with markets taking solace from constructive news on the global banking crisis. The buck was steady but mixed as declines against the UK pound and Canadian dollar were offset by gains versus the yen. The euro was little changed with downside checked by news that German business morale improved for the fifth straight month in March. Helping to temper worries about the health of the global banking sector, one of America’s biggest regional banks, North Carolina’s First Citizens, said it would buy a large portion of Silicon Valley Bank. The deal with U.S. regulators helped to ease a crisis that threatens to pump the brakes on global growth if lenders substantially tighten credit conditions and make it harder for consumers and businesses to borrowing and spend. A material easing of the banking crisis would allow global monetary policy to return to the forefront. Markets will keep one eye on the banking situation and the other on key data this week on U.S. consumer confidence, due Tuesday and forecast to moderate, and Friday numbers on consumer spending and inflation.

German business morale unexpectedly brightens

The euro kept below six-week highs against the greenback but was still on track for monthly and quarterly gains. Helping to keep the single currency afloat Monday was news that Germany’s Ifo survey of business morale brightened for the fifth time in as many months with an improvement to 93.3 in March from 91.1. Business confidence was forecast to moderate slightly amid uncertainty stemming from the banking crisis that momentarily saw the cost of insuring against a debt default for Deutsche Bank, Germany’s biggest bank, skyrocket. EUR/USD has appreciated about 1.8% in March while for the year is up around 0.6%.

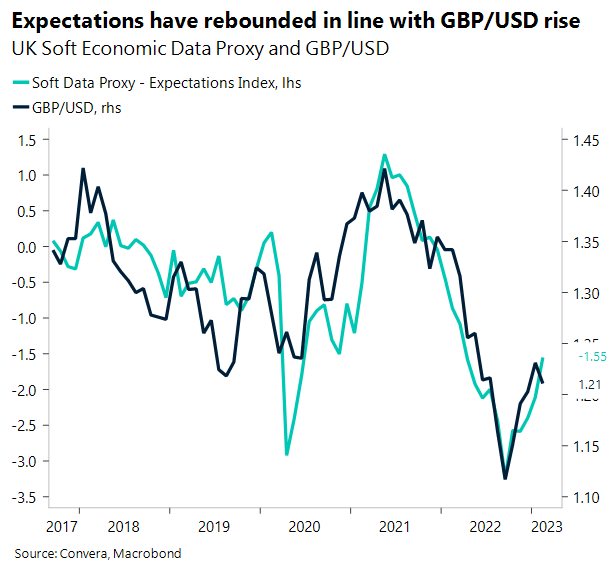

Sterling firms toward 7-week peak

A firmer UK pound Monday held below seven-week highs against the U.S. dollar but found support from improved, though still choppy, risk sentiment. Markets are taking tentative solace from officials’ actions so far to ease the banking crisis. Meanwhile, helping to instill calm Monday, one of America’s largest regional banks, First Citizens, said it would acquire a big portion of Silicon Valley Bank. Data will help guide the pound this week with the final estimate of UK fourth quarter growth due Friday and forecast to confirm the economy flatlined.

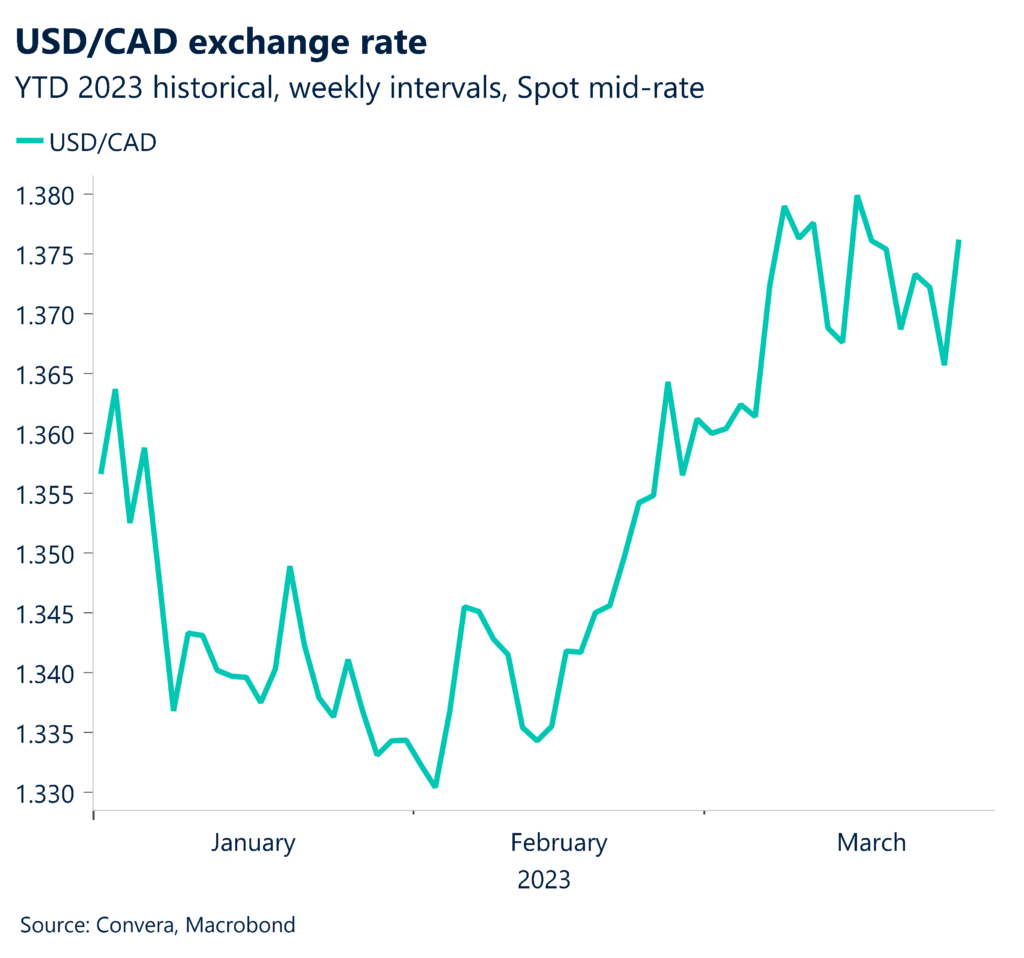

Loonie catches risk-on boost

The Canadian dollar rose above 1 ½ week lows hit Friday against the U.S. dollar thanks to firmer equities and oil markets. The global banking crisis remains fluid, however, with underlying sentiment still jittery. The loonie firmed ahead of Friday data that’s forecast to show Canada’s economy accelerated by 0.4% in January after posting a mild contraction in December. Still, stronger growth to kick off the year, if realized, may not offer much support to the loonie amid expectations for the economy to slow over the coming months, a scenario that’s supportive of Canada’s steady interest rate outlook.

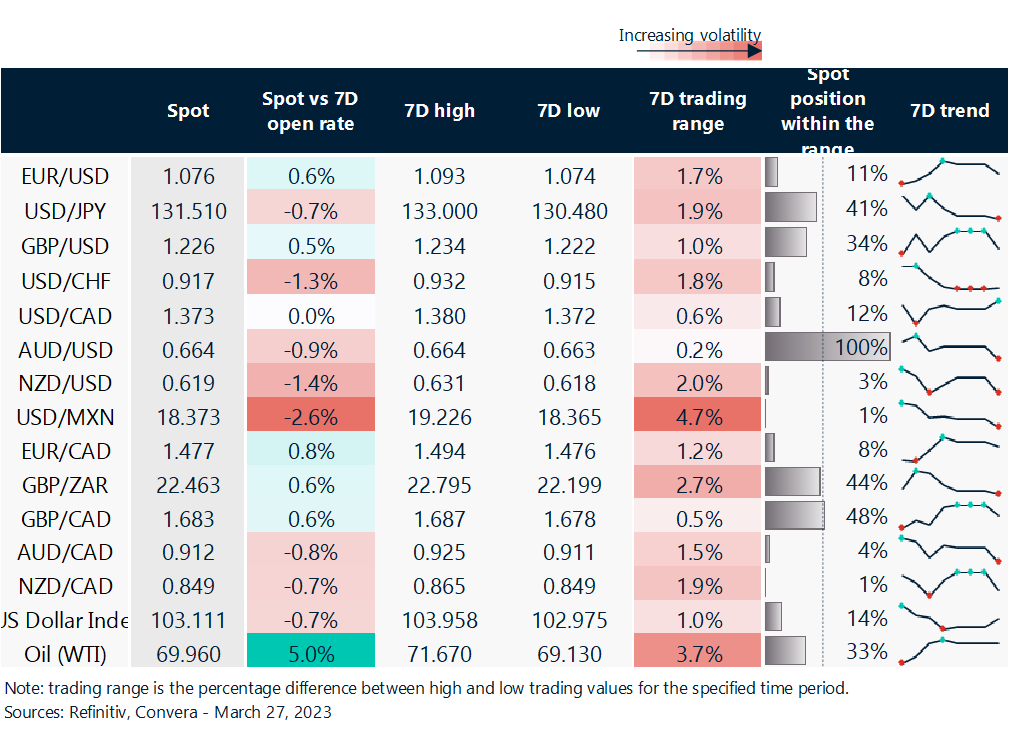

Dollar slumps toward bottom of ranges

Table: rolling 7-day currency trends and trading ranges

Key global risk events

Calendar: Mar 27-31

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.