Written by Convera’s Market Insights team

Dollar’s rally cools after US Treasury Secretary pick

George Vessey – Lead FX Strategist

The US dollar’s stellar run extended last week, pushing the dollar index to fresh 2-year highs, despite US yields ending the week slightly in the red. Dollar demand was buoyed by geopolitical escalation and weak European data relative to the US as per the divergence seen in the PMI numbers on Friday. However, the dollar surrendered some of its gains after President-elect Donald Trump’s pick for Treasury Secretary, Scott Bessent, has been welcomed by investors.

The dollar index rose sharply last week after weaker-than-expected Eurozone PMI data triggered a fresh decline in the euro, which makes up for more than half of the weight of the index’s basket. Contractionary PMIs from Japan and the UK data also pressured the next two heaviest currencies in the index. These contrasted sharply with strong economic data from the US showing private sector growth at its strongest since 2022, driven by solid activity in the services sector. As well as broadly resilient data, a series of hawkish Fed speakers have left the December Fed meeting priced 50/50 for a 25 basis point cut and the terminal rate just under 4%.

This week, we get another data point that will impact the Fed’s thinking – the core personal consumer expenditure (PCE) deflator. This favoured measure of inflation incorporates contributions from both the CPI report and the PPI report, and given the latest reports, the risks appear skewed to the upside for the PCE numbers. Hawkish Fed repricing, US economic outperformance and escalating geopolitical tensions should keep dollar demand buoyed into month end.

European equities and FX have opened firmer this morning though, with the USD softer, as Scott Bessent, Trump’s Treasury choice, is viewed as a measured choice that would inject more stability into the US economy and financial markets. Bessent is seen as a fiscal hawk, with a strong understanding of financial and FX markets, and is expected to favour a more moderate trade policy.

Euro’s downward trajectory is poised to continue

George Vessey – Lead FX Strategist

The euro’s bearish drivers continue to rear their ugly head. Friday’s PMI weakness brought to the fore the possibility of an accelerated cutting cycle by the European Central Bank (ECB) and dragged EUR/USD to a fresh 2-year low beneath $1.04. Meanwhile, heightened geopolitical tensions and policy uncertainties are amplifying sovereign vulnerabilities, while rising global trade tensions are increasing the likelihood of adverse economic shocks.

PMIs surprised on the downside and slid below the 50 no-growth mark in November in Germany, France, and the Eurozone as a whole. In fact, manufacturing PMIs in Germany have never been in contraction for this long. The numbers feed into the narrative that European business confidence is crumbling with the bloc caught between stagnation and technical recession. Risks to the growth outlook are elevated in an environment of looming trade wars and political gridlock in Europe.

This week, inflation for November will be published on Friday and is set to trend up further, mainly on base effects. However, as the Eurozone economy continues to underperform and demand-driven inflationary pressures are set to abate further, the odds of a 50 basis point cut by the ECB in December have jumped. Thus, we see more room for euro weakness in the short term with a $1.05-$1.00 range in sight.

Slowing UK economy to weigh on pound

George Vessey – Lead FX Strategist

The British pound weakened to near $1.25 versus the US dollar last week, the lowest since mid-May, as traders reacted to disappointing economic data. Retail sales fell by a bigger-than-expected 0.7% in October and flash PMIs printed below forecasts, pointing to a fractional decline in business activity during November, driven by a sharp slowdown in both services and manufacturing.

Meanwhile, the headline inflation rate in the UK went up to 2.3% in October, the highest in six months, compared to 1.7% in September, exceeding market expectations of 2.2% and the Bank of England’s (BoE) target. Services inflation, which the central bank views as a key measure of domestically generated price pressure, edged up to 5% from 4.9%, though underlying pressures in services inflation did ease. We think the BoE will leave interest rates unchanged in December, with the odds for a quarter-point reduction currently standing around 16%. Despite the relatively hawkish BoE versus its peers, the pound remains under pressure. This is because although inflation appears sticky, the economic growth outlook is deteriorating, ratcheting up stagflation fears.

Adding to the pound’s struggles were a stronger dollar and heightened tensions stemming from the Russia-Ukraine conflict fueling risk aversion. This morning, however, global risk sentiment is improving and GBP/USD is testing the $1.26 handle once again. But even if we see a retracement all the way back towards $1.28, we still think the $1.30s will be out of reach for some time barring any significant shift in sentiment from across the pond. GBP/EUR remains afloat the €1.20 handle though, and we expect more upside on this pair given widening rate differentials in favour of the pound amidst a more dovish ECB.

Stock and commodities remains buoyant

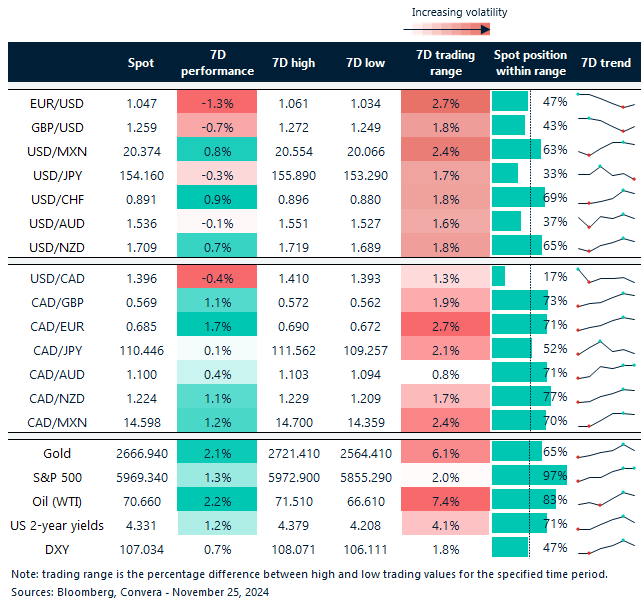

Table: 7-day currency trends and trading ranges

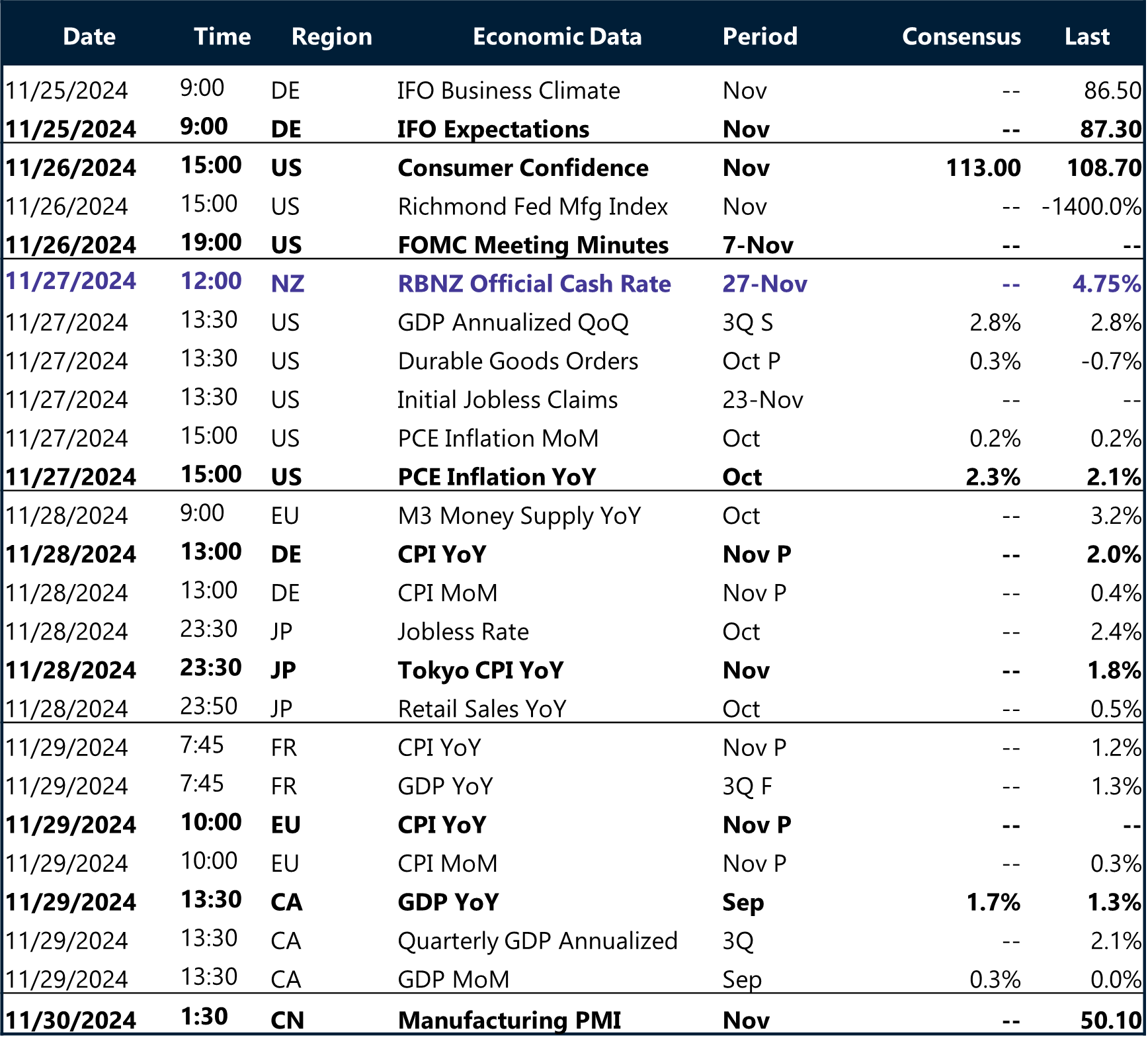

Key global risk events

Calendar: November 25-29

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.