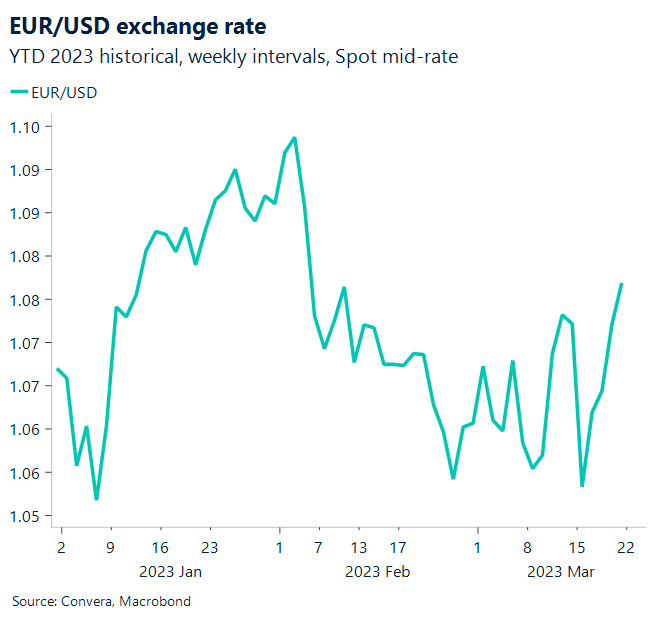

The U.S. dollar remained on the defensive around five-week lows ahead of the Federal Reserve’s second interest rate decision of the year. Ahead of the U.S. central bank’s 2 p.m. ET rate decision, the greenback held above two-week lows versus Canada, but slumped to five- and six-week lows versus the euro and sterling, respectively. As recently as a few weeks ago, the buck had been on a roll after hawkish rate guidance from Fed Chairman Jerome Powell opened the door to bigger rate hikes to keep inflation on a downward path. But a brewing banking crisis has injected higher uncertainty into the path for U.S. borrowing rates which has come at the price of a weaker dollar. Most central bank observers expect the Fed today to raise rates by 25 basis points to a range of 4.75% to 5%. The Fed also will provide new economic projections and offer its best guess at where it sees both inflation and interest rates ending the year. If inflation remains the dominant concern for the Fed and if policymakers still expect rates to peak above 5% then the greenback could stabilize.

Euro boosted by ECB comments

The euro climbed to another five-week high after comments from the ECB president telegraphed an open door to further inflation-taming interest rate hikes. Still, Christine Lagarde said that higher uncertainty across the 20-nation economy meant that central bankers would seek maximum flexibility in setting policy, remarks that stopped short of signaling an imminent rate increase after it boosted borrowing rates last week by a sizable 50 basis points to 3%. The ECB’s data-dependency in setting policy heightens the focus on preliminary PMI surveys from the euro zone on Friday.

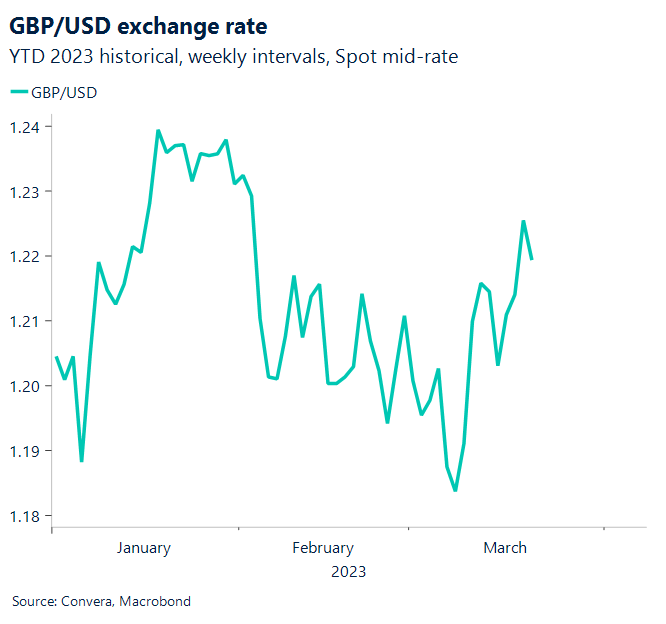

Hotter UK inflation lights a fire under sterling

Sterling powered to new six-week highs ahead of the Fed’s second rate meeting of the year, as hotter than expected UK inflation cemented the case for the Bank of England to raise interest rates Thursday. In a surprise move, UK consumer prices accelerated at a 10.4% annual rate in February, the first rise in four months, compared to forecast to moderate below 10% from 10.1% in January. The inflation setback strengthened the case for the BOE to raise raises by at least 25 basis points tomorrow from 4%. But higher inflation could be a bearish harbinger for UK retail sales on Friday, with spending expected to moderate to a 0.2% increase last month from January’s solid 0.5% rise.

Loonie steadies after data-induced slide

Canada’s dollar steadied after cooler than expected domestic inflation pushed the loonie off a two-week high against its U.S. peer. Data Tuesday showed that Canadian consumer prices cooled more than expected to a 5.2% annual rate in February, the lowest level in more than a year. The downside surprise, which compared to forecasts of 5.4% from nearly 6% in January, was welcome news for Canadian central bankers who may be more inclined to remain on the sidelines for longer. The loonie has struggled to trend higher against the weaker greenback of late, given that Canada was the first of the big central banks to hit the rate hike pause button.

Dollar turns negative for 2023

Table: rolling 7-day currency trends and trading ranges

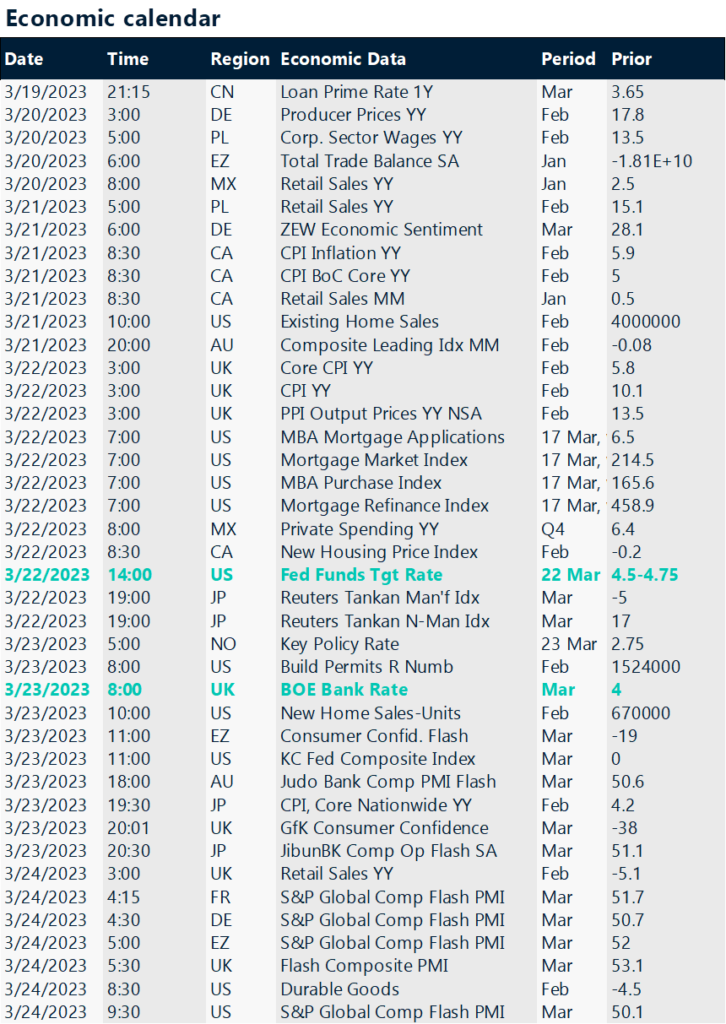

Key global risk events

Calendar: Mar 20-24

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.