Global overview

The U.S. dollar hovered near three-week peaks against a basket of six major currencies following news of a U.S. credit rating downgrade. Rival currencies remained subdued with the euro, sterling, and Canadian dollar pinned around three-week lows. Fitch Ratings – one of the three big U.S. ratings bureaus – downgraded America’s credit rating by a notch to AA+ from a pristine rating of AAA. Fitch cited America’s ballooning deficits and repeated last-minute deals to raise the debt ceiling to avoid a catastrophic default as among the factors that led to the second-ever U.S. credit rating downgrade. The market impact so far has been muted. A key question now is whether the other ratings bureaus, like Standard & Poor’s and Moody’s, will follow suit. The greenback typically enjoys a boost when global uncertainty flares, given its status as the world’s most liquid currency. The dollar, meanwhile, has enjoyed a popularity revival over recent weeks thanks to global data casting the U.S. economy in a comparatively brighter light which is burnishing prospects for a soft landing.

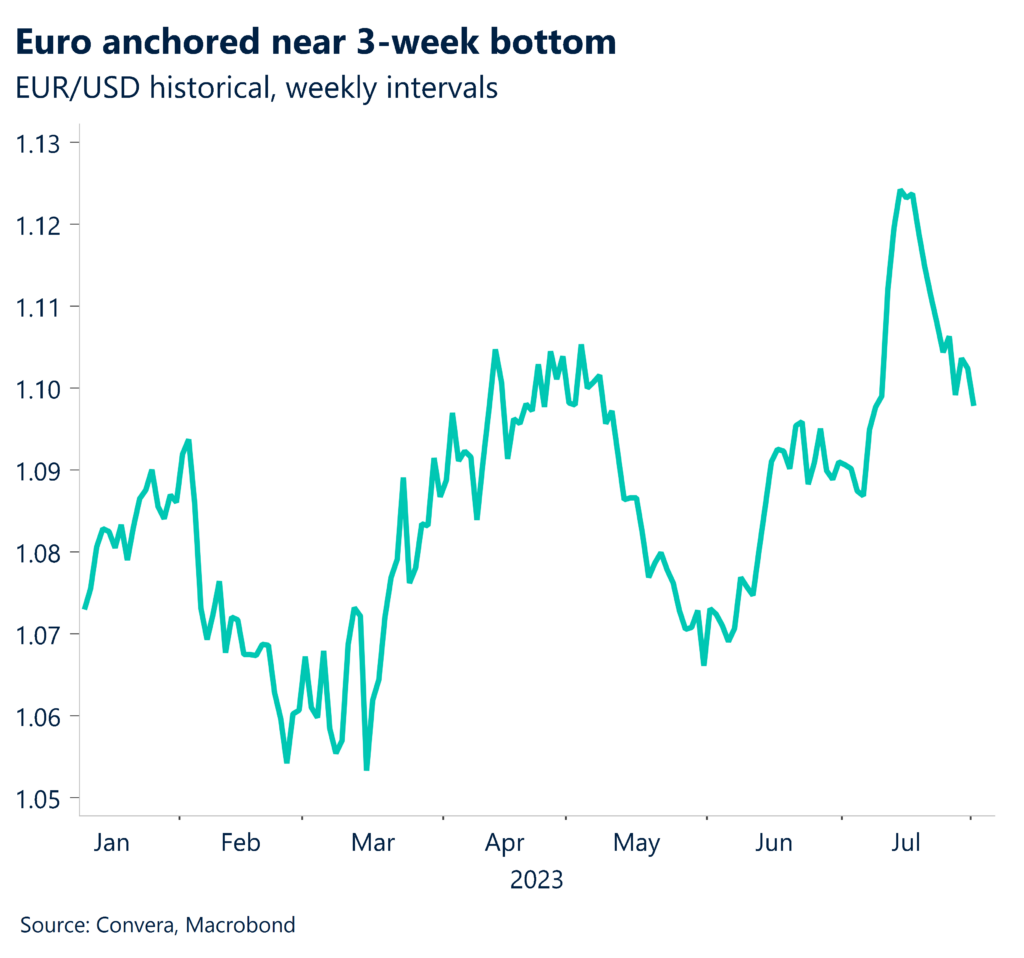

Euro subdued near multiweek lows

The euro continues to tread water barely above last week’s three-week low against its U.S. rival. Upside remains a challenge for Europe’s single currency as rising worries about the bloc’s economic health cast doubt on the ECB raising rates at its next meeting on Sept 14. The ECB has jacked up borrowing rates by a cumulative 425 basis points to 3.75% since it embarked on its aggressive inflation fight in July 2022. Inflation has responded in kind by cooling to a 5.3% annual rate in July, down from a record high above 10% last fall.

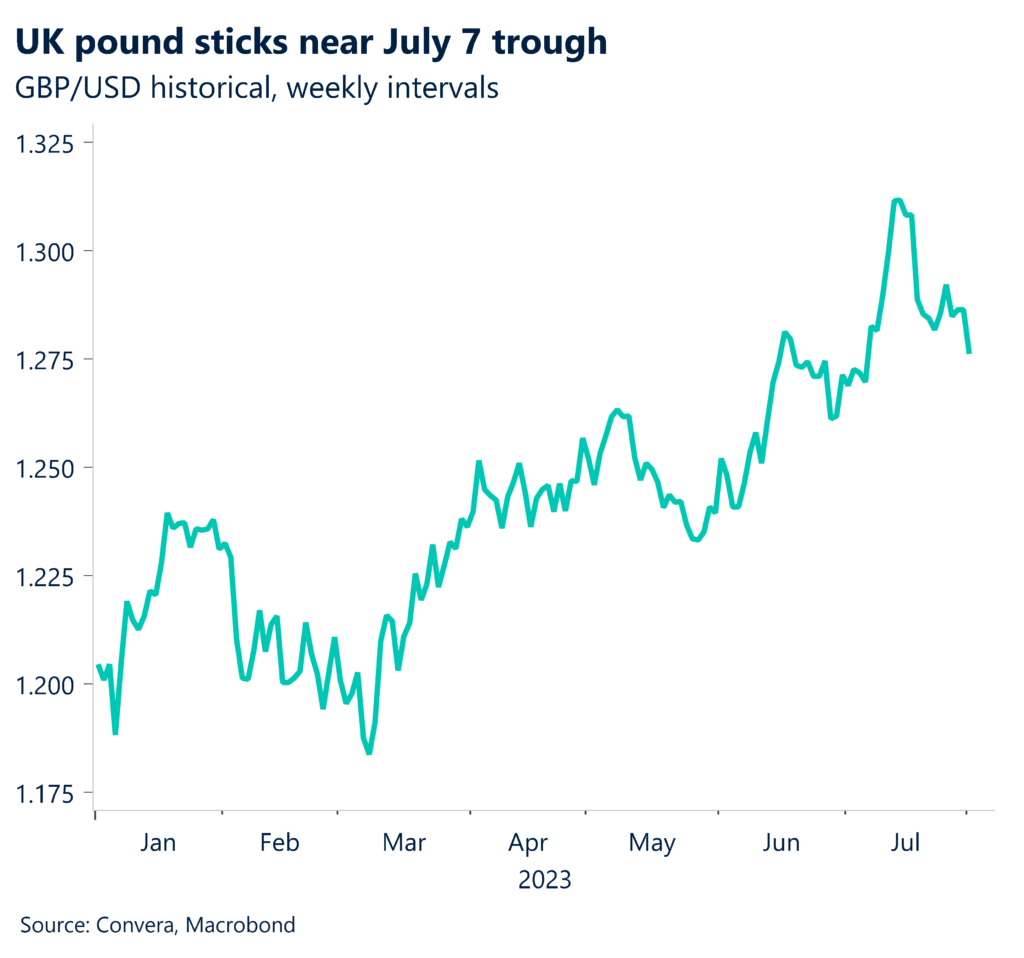

Sterling on back foot ahead of BOE decision

Sterling was pinned near three-week lows against its U.S. counterpart on the eve of a Bank of England interest rate decision. Broad based global risk aversion weighed on the pound along with caution ahead of what’s expected to be the UK’s 14th straight rate hike since December 2021. The market expects London to approve at least a quarter-point hike from 5%, already the highest level in 15 years, to help keep inflation on a decelerating path. A bigger half-point rate hike, combined with weaker than expected U.S. jobs data Friday, could help the pound stabilize after its multiweek slide from 15-month highs above 1.31.

USD/CAD tops 1.33

The Canadian dollar slipped to more than three-week lows against the greenback as risk aversion weighed on commodity-backed currencies. The loonie also traded defensively on caution ahead of Canada’s monthly jobs report on Friday that’s forecast to show further signs of a moderating economy. Slowing hiring and an uptick in unemployment are in the cards with July job growth seen slightly above 20K after June’s robust gain of nearly 60K. Markets will use the jobs report to fine tune expectations for the next Bank of Canada rate meeting on Sept 6.

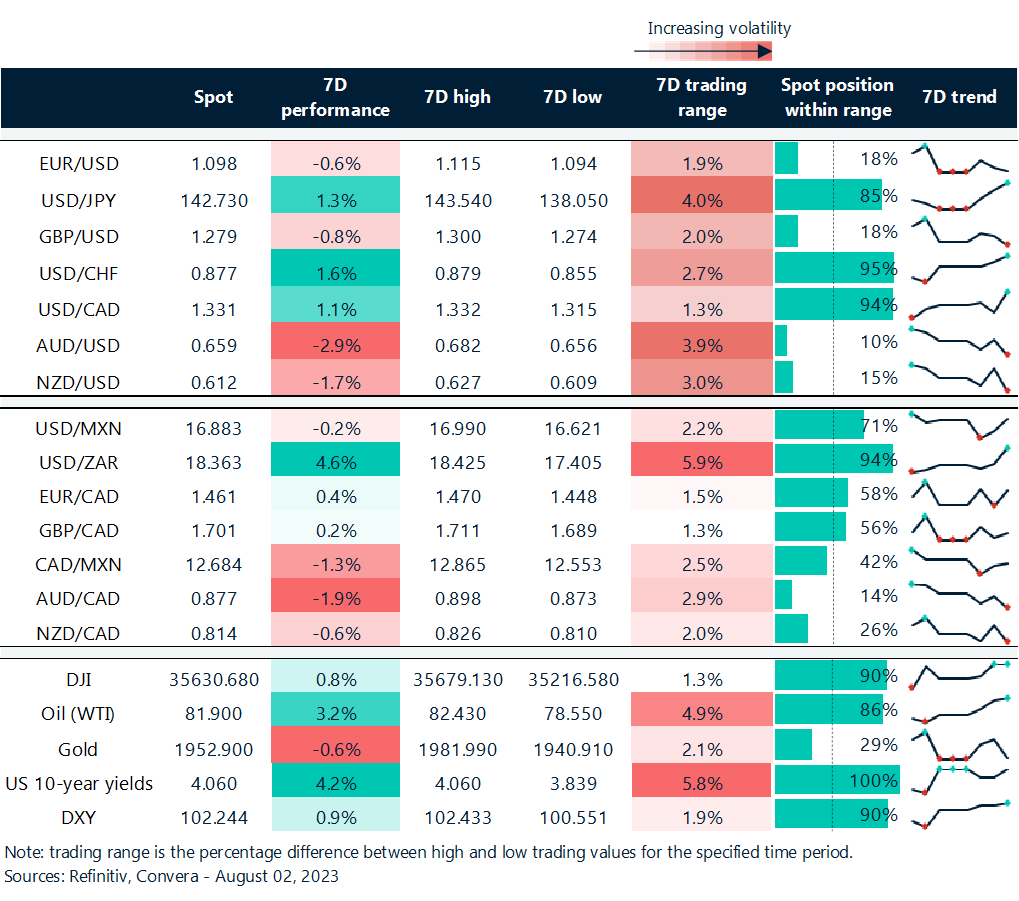

Dollar shrugs off U.S. credit rating downgrade

Table: rolling 7-day currency trends and trading ranges

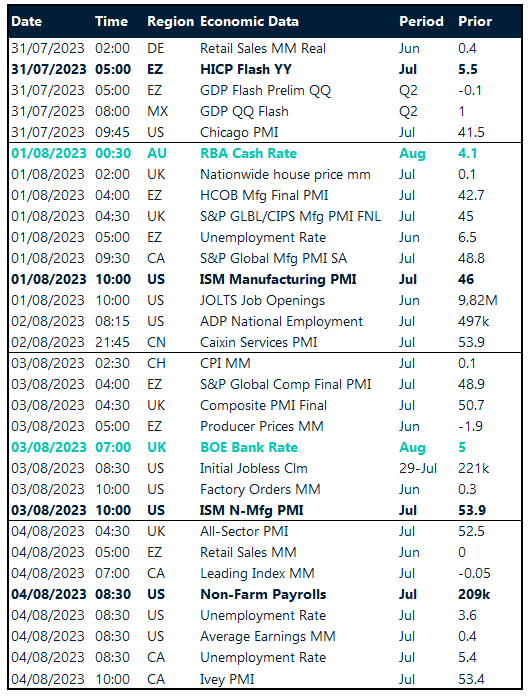

Key global risk events

Calendar: Jul 31-Aug 4

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.