Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

Dollar dips after Bessent nomination by Trump

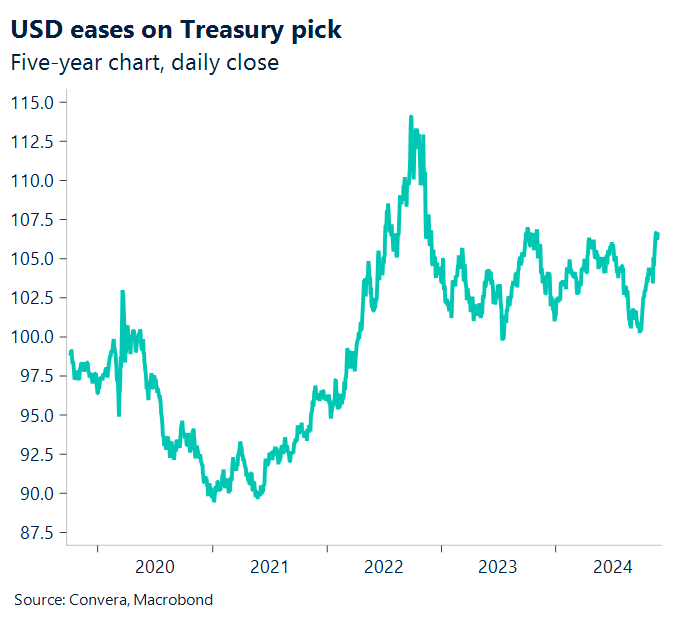

The USD index climbed 0.5% to 107.5, on Friday NY close, as contrasting economic data between Europe and the US drove market sentiment.

The Euro was a notable underperformer, with EUR/USD dropping 0.5% below 1.04 after disappointing Euro area PMI data showed services sector weakness across all countries.

The British pound declined 0.5% versus the USD following weaker-than-expected UK PMI data with both manufacturing and services missing forecasts.

The Canadian dollar showed resilience, ending flat against the USD despite broad dollar strength, supported by stronger-than-expected retail sales data.

However, key trade-exposed currencies like the Australian dollar, Chinese yuan and euro rebounded late on Friday on news of the nomination of Scott Bessent as US Treasury Secretary.

Bessent is well-known hedge fund manager who runs macro fund Key Square Group. More importantly, Bessent is seen as a fiscal hawk, with a strong understanding of financial and FX markets, and is expected to favour a more moderate trade policy.

While US shares were positive on the news, Bessent’s appointment saw the USD index ease on Friday evening after the greenback’s massive 8.0% rally over the quarter-to-date.

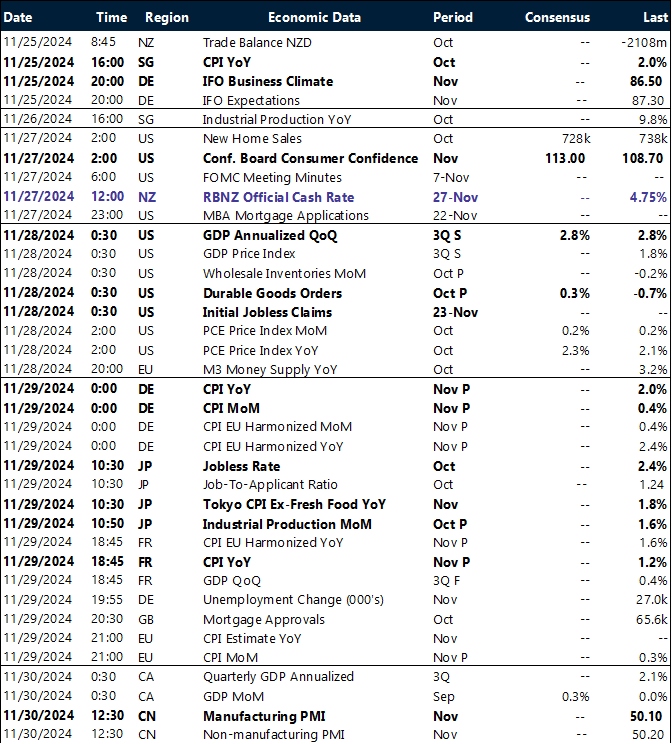

Economic data calendar drives markets this week

FX markets will be focused on key economic data releases this week with important indicators due from major economies including the US, Europe, Japan, and China.

The US takes center stage with Q3 GDP second reading and PCE inflation data on Thursday. Markets will closely watch the PCE deflator given its importance for Fed policy.

European inflation readings dominate the latter part of the week, with German HICP and Eurozone-wide HICP on Friday. Spain, France and Italy also report preliminary November inflation figures.

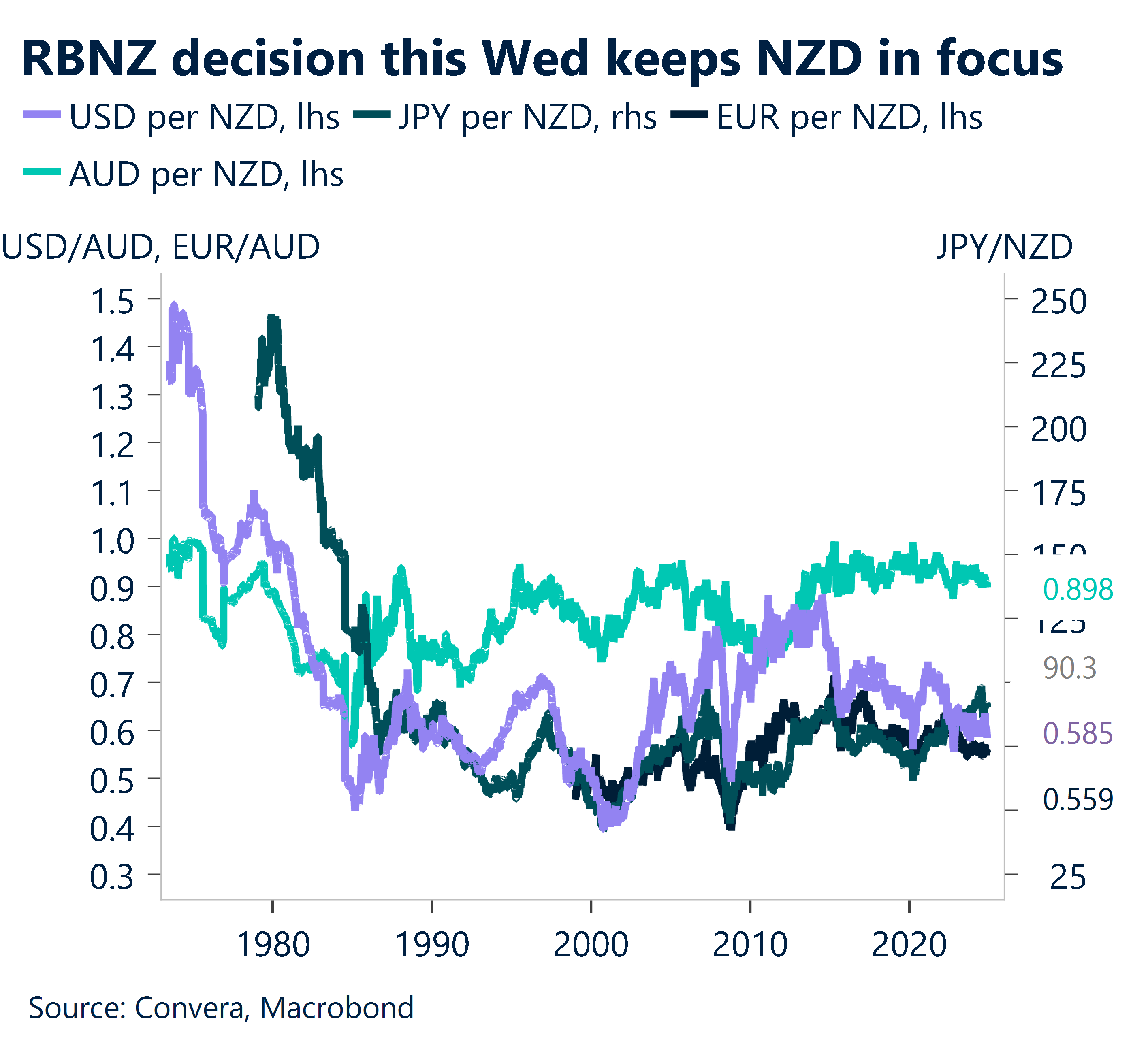

The Reserve Bank of New Zealand’s rate decision on Wednesday stands as the week’s sole major monetary policy event. With markets pricing in a 4.25% rate expectation, any deviation from this consensus could trigger significant volatility in the New Zealand dollar and potentially influence broader Asian currency markets.

Market participants should note that Thursday marks the US Thanksgiving holiday, with US markets closed. Trading volumes typically remain lighter than usual on Friday as well, as many US participants extend their holiday break.

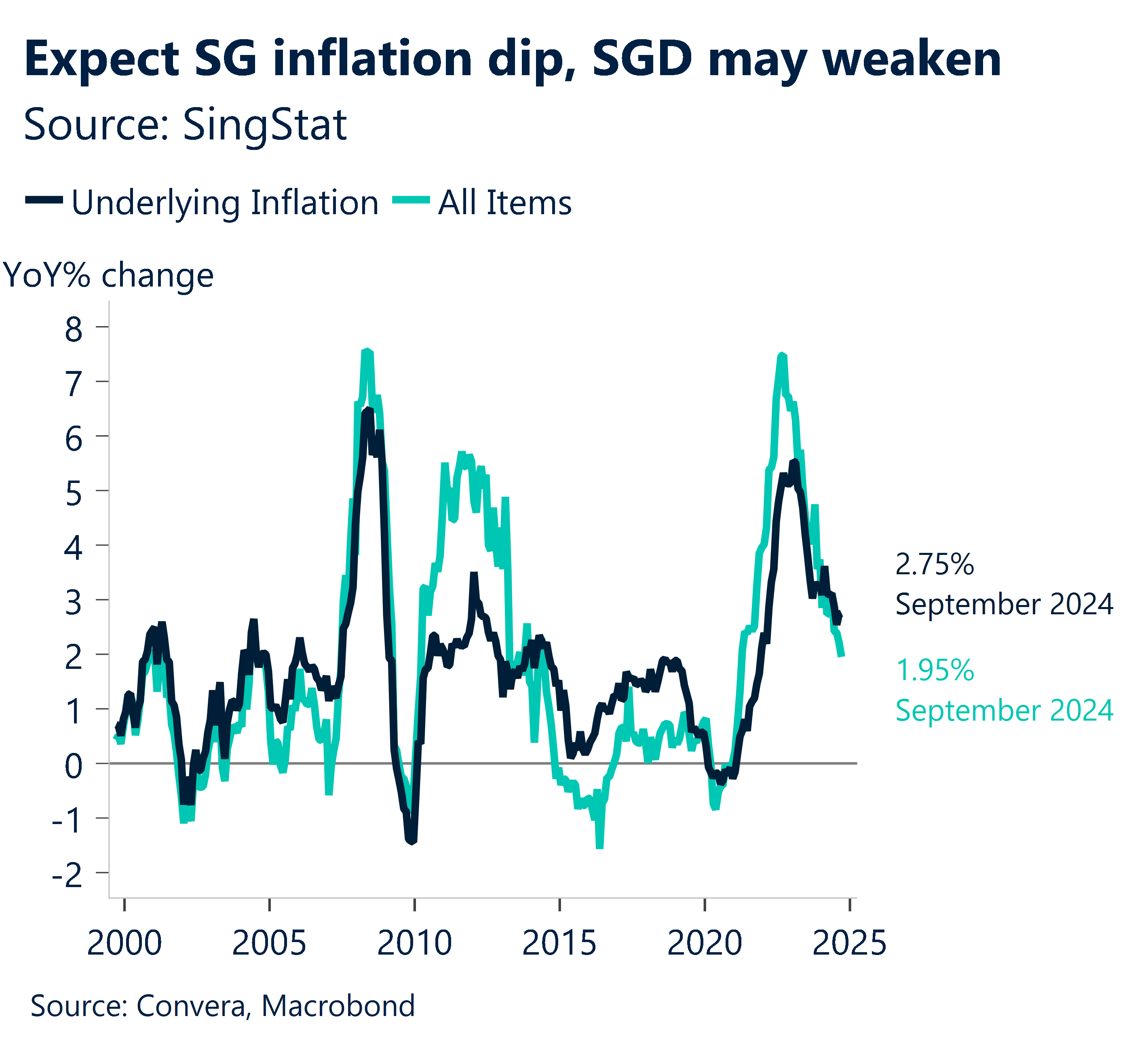

Singapore inflation dips; SGD ranges

Today at 16:00 AEDT, the Singapore CPI will be issued.

Due in part to favorable base effects, we anticipate core inflation to decrease from 2.8% in September to 2.6% year over year in October.

Sequentially speaking, this means that core inflation increased marginally from 0.1% to 0.2% m-o-m, in part because of the ongoing increase in the price of raw foods.

In terms of technical price action, the 50 day EMA looks poised to cut 200 day EMA from below which may signal more gains in USD/SGD pair. The next resistance rests at YTD highs of 1.3655

Key trade FX AUD rebounded on Bessent nomination

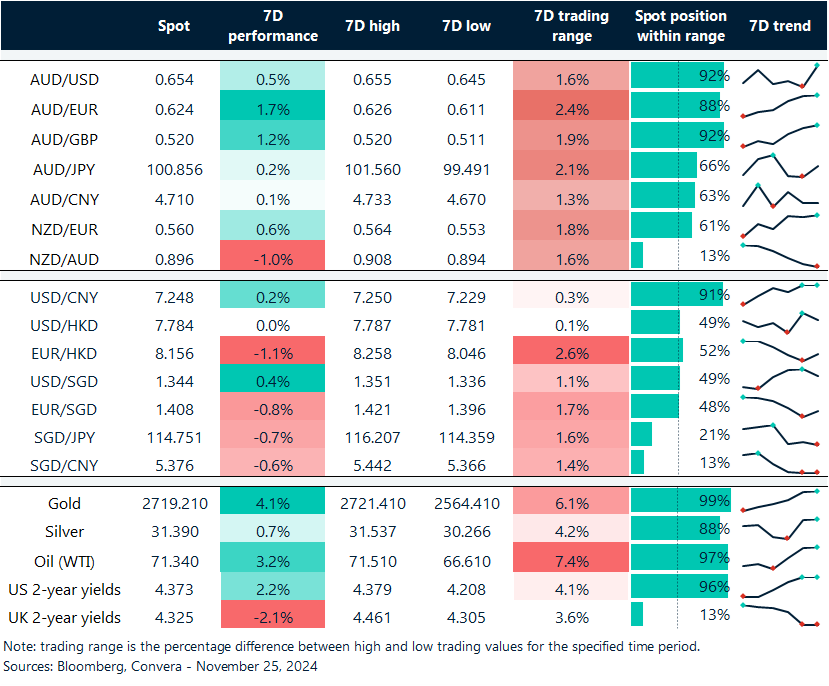

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 25 – 30 November

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.