Haven demand cools as banking fears ease

A sense of cautious calm helped quell safe haven demand, which allowed the US dollar and other major currencies to lift over 1% higher against the Japanese yen yesterday. Global equities made a strong start to the week on the news of additional support for banks from US authorities as fears of broader contagion from the banking turmoil eased.

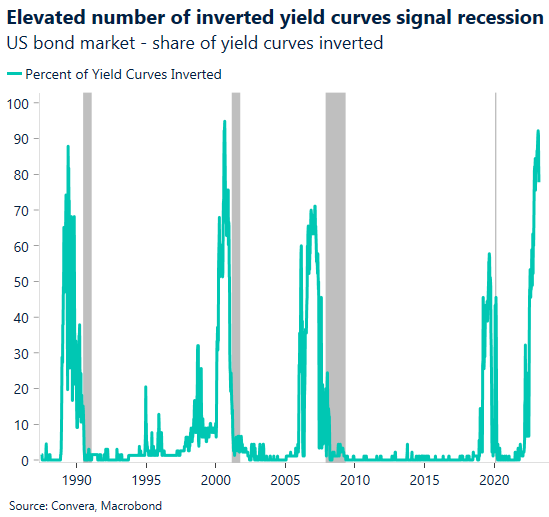

The weekend brought some relief to financial markets and yesterday saw regional US banks rebounding after First Citizens Bank agreed to buy Silicon Valley Bank. US authorities are also considering expanding an emergency lending facility that would give lenders more time to bolster balance sheets. This helped buoy risk appetite. Still, a gauge of regional US banks has lost 30% since early February and with nearly 80% of US yield curves inverted, the risk of a deeper-than-expected recession is still on the table. The US Federal Reserve (Fed) is expected to soon pause from raising interest rates and instead pivot to rate cuts as early as July. Investors will be closely watching the Fed’s preferred measure of inflation on Friday to help guide expectations on the US central bank’s rate path, but before then, an influx of key housing data and general business activity data for manufacturing and services will be closely scrutinised today.

The dollar index, which measures the currency against six rivals is a touch higher from a 7-week low reached last Thursday. EUR/USD crept higher though, lingering just short of $1.08 following a run of five weekly gains in a row. The $1.10 level is a key upside target, but the 50-week moving average ($1.0971) is proving a tough resistance barrier to overcome.

Pound eyes March highs

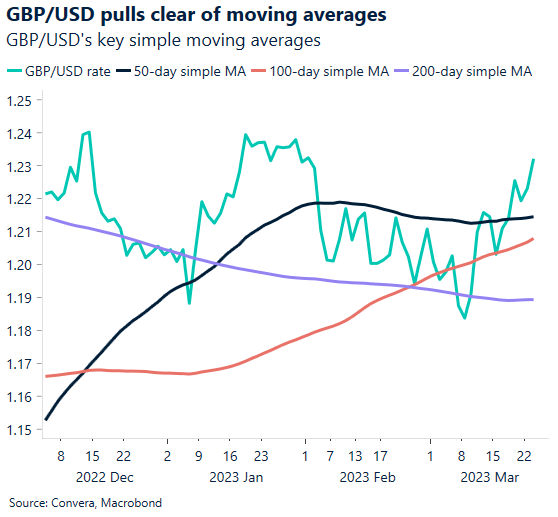

The British pound followed equities higher at the start of the week, as risk appetite improved globally amid easing concerns around the durability of the banking system. Further supporting the pound is falling Fed rate expectations leading to a narrowing of US-UK yield spreads, whilst a more resilient UK economic outlook should also act as a buffer. GBP/USD might soon re-test March highs in the mid-$1.23 area.

GBP/USD is trading above all its key long-term daily moving averages and after closing above its 50-week moving average a couple of weeks back, and then above its 10-week moving average last week, there’s a growing sense of upward momentum building for GBP/USD. Aside from simple technical analysis, if the banking turmoil does not spread more through Europe and if the UK recovery narrative gains traction, the cheap pound may continue to be snapped up by investors. However, this process will be gradual, given relatively high levels of external debt and a wide current account deficit. Meanwhile, the Bank of England (BoE) is expected to hike one more time by 25-basis points in either May or June, though BoE Governor Andrew Bailey repeated yesterday that further monetary tightening would be required if signs of persistent inflationary pressure became evident.

Against the euro, the pound looks marginally less attractive due to the more hawkish rhetoric of the European Central Bank compared to the BoE. GBP/EUR clocked its third daily rise in a row though before once again recoiling from its 100-day moving average just under €1.14.

Business outlook holds up despite protests

Paris, London and Berlin are just some cities’ caught up in strikes or upcoming protest surrounding the cost of living crisis. France is bracing for another round of protests today, nearly two weeks after President Emmanuel Macron rammed through a pension reform through parliament using a special provision. In Germany, air and rail services grounded to a halt on Monday, with the unions demanding a raise of 10.5% for public sector workers while security guards at London’s busiest airport plan to go on a strike over the Eastern holiday’s.

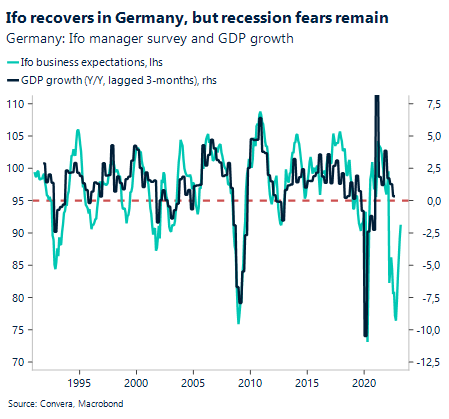

On a more positive note, the turmoil surrounding the banking sector in the US and Europe and continent wide strikes have so far had a limited negative impact on sentiment data. The German business outlook continued to improve going into March, with the expectations index published by the Ifo institute rising to 91.2 from 88.4. German managers improved their outlook on the economy for the fifth consecutive month, lifting the overall sentiment to its highest level in over a year. At the same time, the 11 percent rebound in the stock price of Deutsche Bank continued the series of positive news at the beginning of the week, strengthening the risk on sentiment at the weekly open.

For now, selling pressure of US regional and European banks seems to have eased. With no negative headlines coming through since Friday, markets have calmed a bit. It is still unclear to what extent the turmoil in the banking sector is already behind us. However, the longer time goes on without significant news on the banking front, the more will investors shift to interpreting macro data and monetary divergences as the renewed market driver.

Risk-on sentiment prevails for now

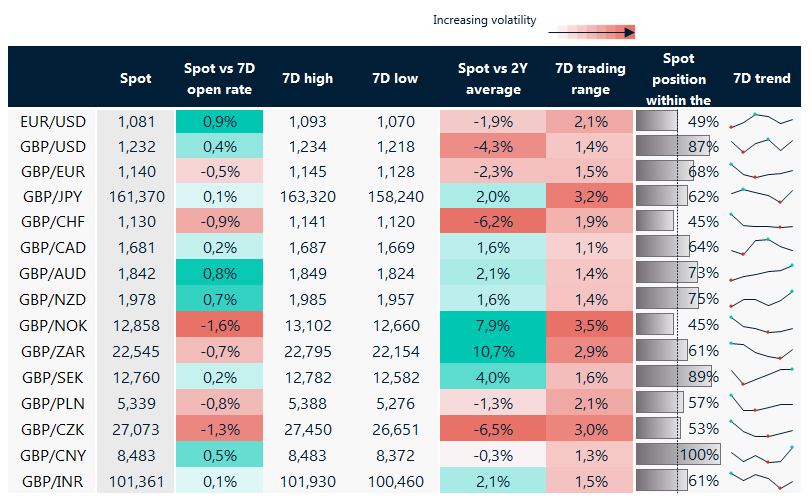

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: Mar 27 -Mar 31

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.