Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

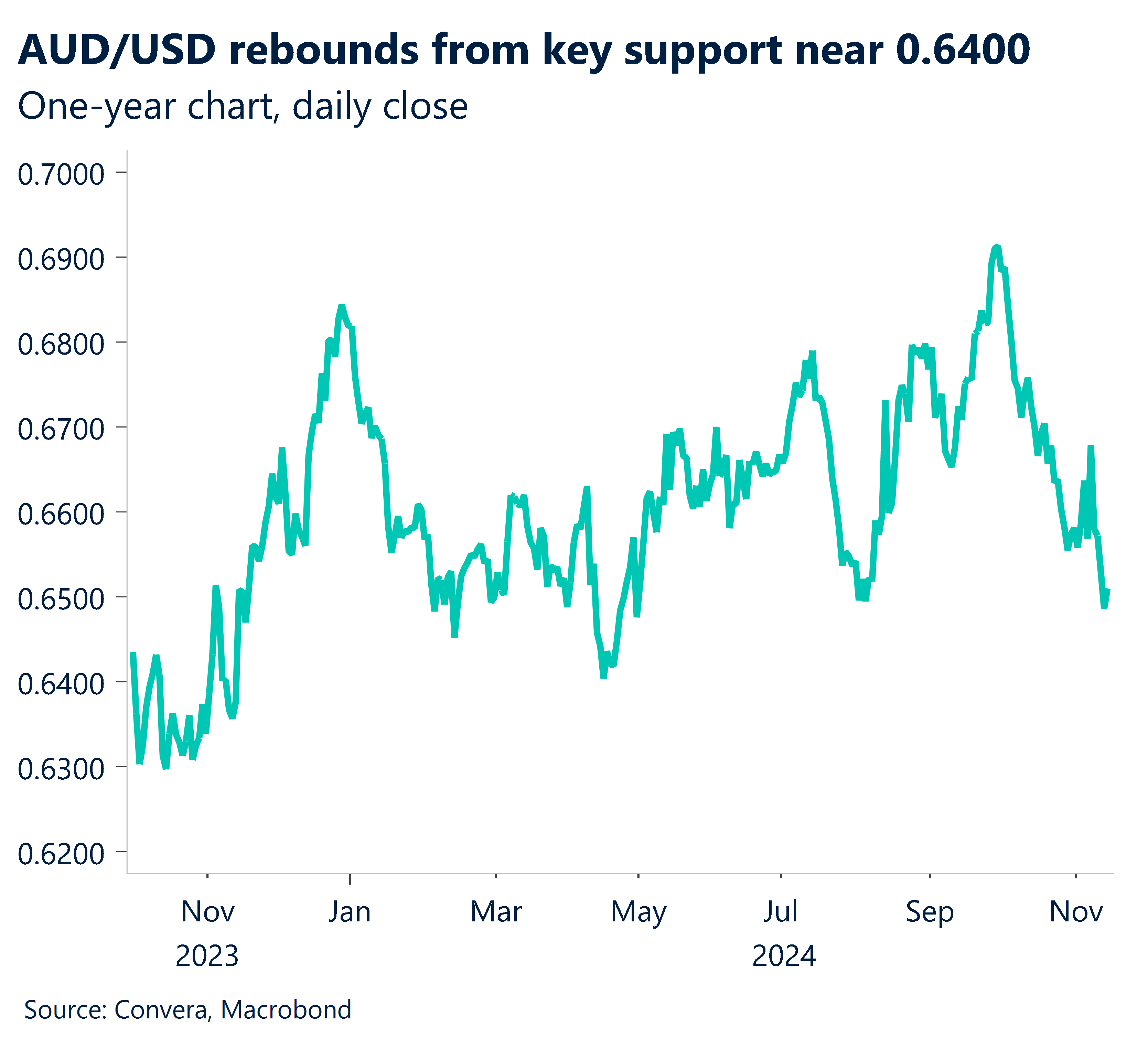

Aussie higher ahead of RBA

The Australian dollar led a mini-rebound versus the greenback overnight that saw the US dollar ease from two-year highs

The AUD/USD gained 0.7% as it climbed from three-month lows.

The US dollar was weaker in most markets after a super-charged rally that saw the world’s most traded currency gain 6.3% over the December quarter so far before easing in the last two sessions.

In other markets, the EUR/USD and GBP/USD both gained 0.5%, while NZD/USD gained 0.4%.

In Asia, USD/SGD fell 0.3%, USD/CNH lost 0.1% while the USD/JPY bucked the trend and climbed 0.2%.

Looking forward, all eyes will be on the Reserve Bank of Australia minutes, due at 11.30am AEDT. At their 5 November meeting, the RBA continued highlight the ongoing inflationary risks basically eliminating any chance of an Australian rate cut by the end of the year and supporting the AUD.

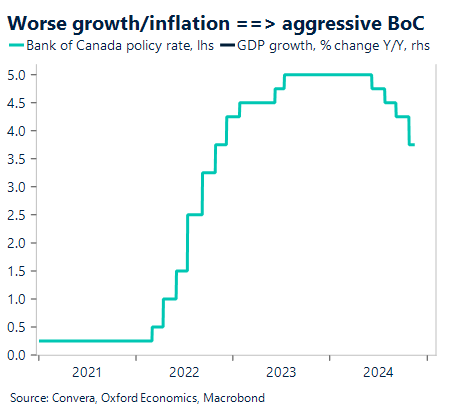

BoC easing bias supports USD/CAD upside

In a relatively quiet week for FX data releases, Canadian CPI will be in focus after 125bps of cuts from the Bank of Canada this year. Canadian CPI is due at 12:30am AEDT on Wednesday.

Next year, the slowing Canadian economy is probably going to keep the Bank of Canada on an easing path. The labor market has loosened and growth has been slow in recent quarters.

According to some metrics, inflation has been at or just around 2%. As opposed to last month’s -0.4%, we’re looking for CPI MoM to be 0.2%.

In contrast to the Fed, where risks are skewed toward fewer cuts next year, the slowing Canadian economy appears likely to keep the BoC on an easing path overall.

Even at four-year highs, the USD/CAD might continue to gain further due to this policy difference between the US and Canda.

In the short term, we remain more pessimistic on CAD since the worsening domestic growth/inflation mix has prompted a reconsideration of more aggressive BoC easing.

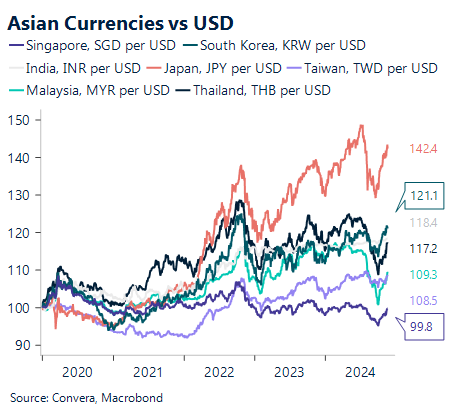

Ringgit, emerging FX hit by USD strength

Across Asia, emerging FX has been hit hard by the rising US dollar following the election. The Thai baht has been the hardest hit, down 2.5% over the month, with the Malaysian ringgit also pressured, down 2.1% in November.

Looking forward, Malaysia trade balance will be released today. The goods trade surplus is predicted to decrease from MYR13.2 billion in September to MYR8.5 billion in October.

With palm oil exports growing more strongly as a result of stockpiling ahead of higher export tariffs, export growth probably increased significantly from -0.3% in September to 7.1% year over year in October.

However, import growth stayed strong and increased slightly from 10.9% year over year to 11.8%, which is consistent with strong local demand.

From Bank Negara, policy rate changes are probably not going to happen anytime soon. But BNM could be prompted to step up engagement with government-linked firms again if USD/MYR nears YTD highs. At current levels, there’s still way ahead before reaching YTD highs of 4.7955.

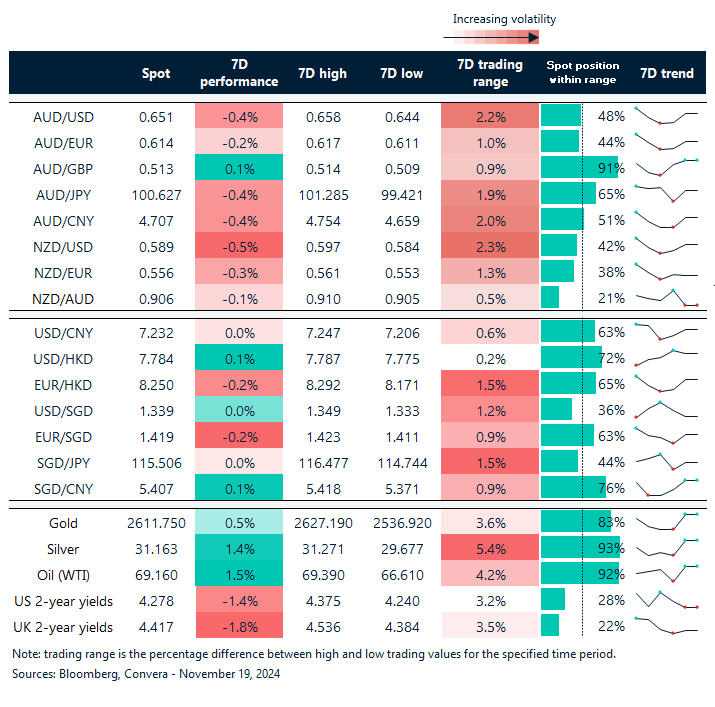

USD slips from two-year highs

Table: seven-day rolling currency trends and trading ranges

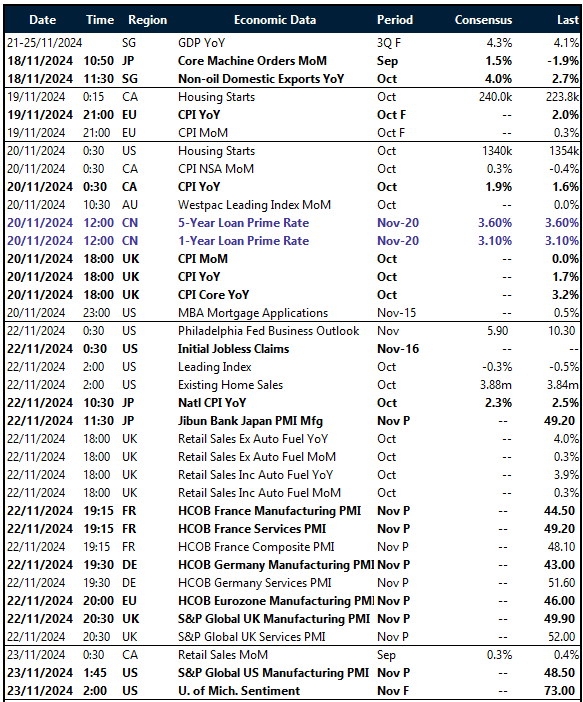

Key global risk events

Calendar: 18 – 23 November

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.