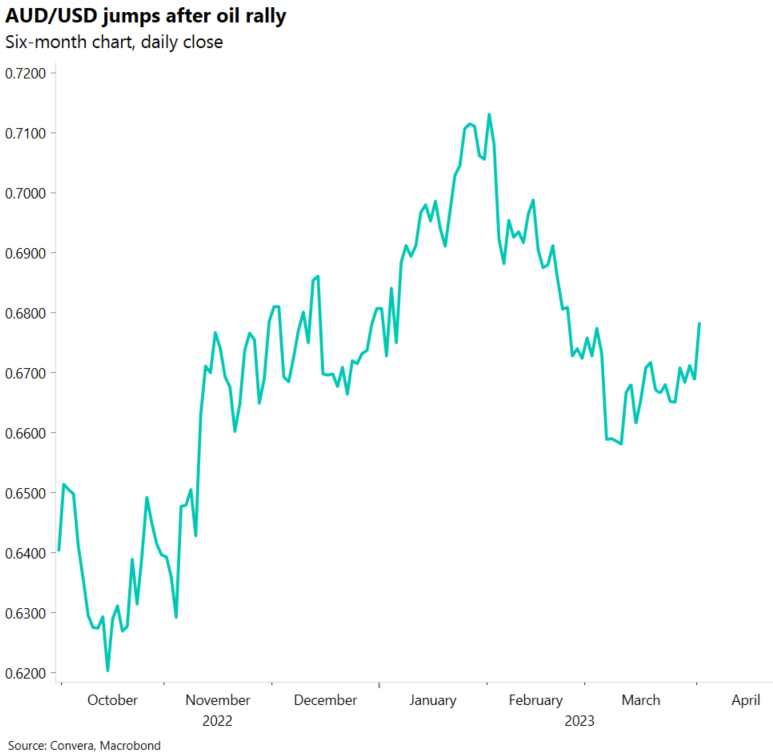

Aussie hits five-week highs on oil rally

The Australian dollar surged higher overnight ahead of today’s key decision from the Reserve Bank of Australia.

The AUD/USD gained 1.5% in its biggest one-day gain since 6 January.

The NZD/USD also climbed up 0.6%.

The Aussie was helped by news of a production cut from OPEC (Organization of Petroleum Exporting Countries) that boosted the price of crude oil. Oil jumped 6.5% yesterday and caused sharp gains in other key energy markets.

The oil news didn’t dent share market optimism however with the Dow Jones up 1.0% and the S%P 500 up 0.4%. The Nasdaq fell.

Manufacturing data extends poor run; USD weaker

The Aussie’s gains came despite a volatile session that continued to point to an ongoing slowdown in manufacturing activity.

In last week’s global PMI (purchasing managers index) releases, a clear divergence could be seen between manufacturing PMIs, which underperformed, and services PMIs, which remain strong.

Again, yesterday, Chinese and US manufacturing PMIs both struggled. China’s Caixin manufacturing PMI was reported at 50.0 (versus 51.4 expected) while the US manufacturing PMI fell to 46.3 (versus the 47.5 expected).

The USD fell on the weaker PMI numbers and supported the AUD and NZD’s gains.

A slowdown in demand for manufactured goods after the massive pandemic-driven spending spree is one reason for manufacturing’s slowdown, but the big buildup in inventories seen over the last two years is another driver.

US inventories still remain near the highest year-on-year growth rate on record and, as businesses try and run-down these inventories, demand for manufacturing has eased.

RBA in focus with analysts split

Today’s focus is on the Reserve Bank of Australia decision at 2.30pm.

After a shift in tone from the RBA in recent statements, and last week’s lower than expected inflation reading for February, markets now expect the RBA to hold. The latest market pricing sees an 87% change the RBA will keep rates steady. (source: Refinitiv).

However, analysts are less convinced. According to Reuters, 14 out of 38 analysts surveyed still believe the RBA will hike today, including ANZ, Goldman Sachs and NAB.

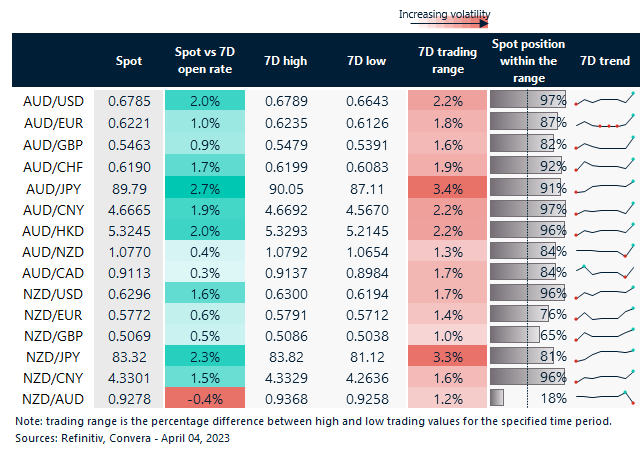

Aussie at highs across markets after oil shock

Table: seven-day rolling currency trends and trading ranges

Key global risk events Calendar: 3 – 7 April

All times AEST

Have a question?[email protected]