UK Prime Minister Rishi Sunak surprised the country and markets by calling an early general election for July 4 — the UK’s first July election since 1945. Following high inflation figures, the PM hopes to frame his campaign around a narrative of economic recovery.

So what should you expect for the summer poll and how will it affect foreign exchange? Let’s take a closer look at the potential scenarios and what makes this summer poll unique, including its relationship to the forthcoming US elections in November of this year.

The stage is set for a summer showdown

During the last UK election in 2019, the Conservatives won an 80-seat majority while Labour suffered its worst election defeat since 1935. Political volatility was rife amid Brexit-related uncertainties, and the British pound was vulnerable to sharp and significant price swings.

Times have changed since then.

Brexit is no longer a political hot topic spawning added uncertainty. The opposition Labour Party is more than 20 points ahead of the ruling Tory Party in the polls — a gap that will probably narrow but will be extremely challenging to overturn.

Markets usually prefer continuity over change, but Labour’s shift to a more pro-business, center-ground position is seen as favorable for UK assets. Plus, potentially closer ties with the European Union could help narrow the pound’s so-called Brexit risk premium.

Ultimately, though, neither party is promising radical fiscal policy shifts, and neither party is going to want to spook financial markets like Liz Truss did back in September 2022. Therefore, it’s possible that this election campaign will be much less volatile and the direction of UK assets, like the pound, will likely be dictated more by fundamental economic drivers and by the timing and pace of Bank of England rate cuts.

Key dates and initial expectations

- When will the election results be in? Voters hit the ballots on July 4th, with voting coming to a close at 10 PM. Results should be clear by dawn on July 5th.

- What do the early polls show? Labour is shown as the favorite in early polls, but these are subject to change (and sometimes they get the results very wrong). The Tories had an 11-point lead going into the 2017 election, which resulted in a hung parliament.

- What is the potential impact on the market? Thus far, markets show a muted reaction with the sterling edging up to a multi-month high. Still, expect volatility to rise in the run-up to the vote.

Why the GBP calm might be temporary

So what can you expect as election day draws nearer? In short, volatility.

Financial markets seem ambivalent about the UK’s coming general election, as evidenced by the muted reaction of UK assets like the pound. Typically, FX spot markets tend to ignore elections until the final stages — filtering out much of the political noise of campaigning and early polling.

As election dates get nearer though, the number and frequency of opinion polls notches higher, leading investors to take more notice and often causing FX volatility to increase.

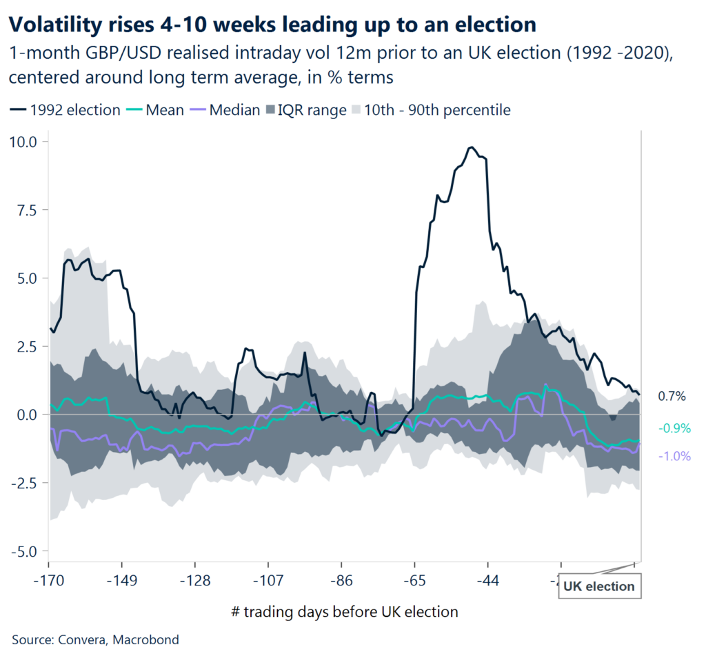

On average, 1-month GBP/USD realized intraday volatility tends to remain benign when measured against its long-term trend, but it tends to persistently pick up around 4-10 weeks leading up to an election day. Closer to election day — usually within a month — volatility, on average, tends to cool as it becomes more apparent which party will clinch the victory.

Understanding volatility ahead of the election

Elections pose sizable tail risks, and the risk to FX volatility is heavily skewed to the upside.

An example of this is the 1992 UK election, which is the only instance in history where a UK and a US election coincided in the same year. Back then, the two presidential elections were separated by a 7-month gap, but the proximity of the two events kept GBP/USD realized volatility systematically elevated above historical levels throughout the entirety of the 12-month period leading up to the UK election day.

The upcoming 2024 UK election is the only other instance of the two events taking place during the same year, let alone in such proximity — separated by a mere four months. With the announcement still fresh and FX markets yet to react to the news, volatility is expected to climb as election day draws nearer.

Potential UK election outcomes and their market impact

What could happen in the event of a hung parliament, narrow Labour majority, Conservative win or large Labour victory?

With a total of 326 seats needed for a majority in the House of Commons, check out some of our projections for each outcome scenario and what it may mean for the GBP.

- Hung parliament: In the event that no party wins an outright majority, Labour could rely on Lib Dem and/or SNP support. This also raises the odds of a Scottish referendum. Such elevated uncertainty could weaken economic growth prospects and result in lower BoE rates — causing a major downside risk to GDP.

- Narrow Labour majority: A slim Labour majority leaves Starmer more reliant on the left wing and raises the potential for more expensive fiscal policy in the future. Although this could push up BoE and market rates, it could also present a downside risk to GBP.

- Conservative win: Continuity is usually favored by markets. However, given the lack of confidence amongst Tory MPs in PM Sunak, they map opt for a new leader to steer the ship. This elevated political uncertainty could trigger market volatility.

- Large Labour majority: A victory of great magnitude that allows a new government to more easily implement policies may be welcomed. This scenario could be an upside risk to GBP, but BoE policy will determine its direction and expected rate cuts could limit gains.

Unpacking GBP future scenarios

What lies ahead for the GBP? On average, GBP/USD tends to appreciate by close to 2% one quarter after a UK election but bleeds away the gains by the 12-month mark. Interestingly, after the first 100-days — a typical milestone in any election across the globe — GBP/USD reaps the highest return, appreciating by an average of 3.5% regardless of the winning party.

Markets, rightly or wrongly, tend to conclude that Tories are better managers of the economy. This is why sterling has, on average, historically outperformed on a Conservative victory. GBP/USD has averaged 3% gains in three months after such a result, and although these gains recede through the year, GBP/USD has dropped, on average, over 2% in nine months after a Labour victory.

It is by no means a given that the pound always weakens under a Labour government, though. Labour Prime Minister Tony Blair’s landslide victory in 1997 saw GBP/USD rally 4% in the first year. That was a more centrist Labour Party and there wasn’t a lot of election uncertainty in the run-up to the vote — a similar setting to what’s in place now.

One thing is sure: This snap election carries serious weight for the UK and GBP’s trajectory in the short and long term.

*We are not assigning specific exchange rate predictions to our election analysis given we believe any volatility will most likely be “noise” and the direction of the pound over the course of 2024 is more likely to be determined by monetary policy paths/divergence of major central banks (e.g. BoE-Fed and BoE-ECB).

Want more insights on the topics shaping the future of cross-border payments? Tune in to Converge, with new episodes every Wednesday.

Plus, register for the Daily Market Update to get the latest currency news and FX analysis from our experts.