US shares extend this week’s gains

The Australian and NZ dollar pressed up towards the top of their recent trading ranges overnight as global markets extended this week’s more hopeful mood.

The US’s S&P 500 gained 0.6% while the Nasdaq gained 0.9%.

This week’s moves continue to be driven by hopes that US and European banks will be able to withstand their recent stability issues.

US bond yields were broadly steady while commodities gained – copper climbed 0.6% while crude oil gained 1.9%.

Aussie, kiwi higher

The Australian and New Zealand dollar benefited from the improved optimism.

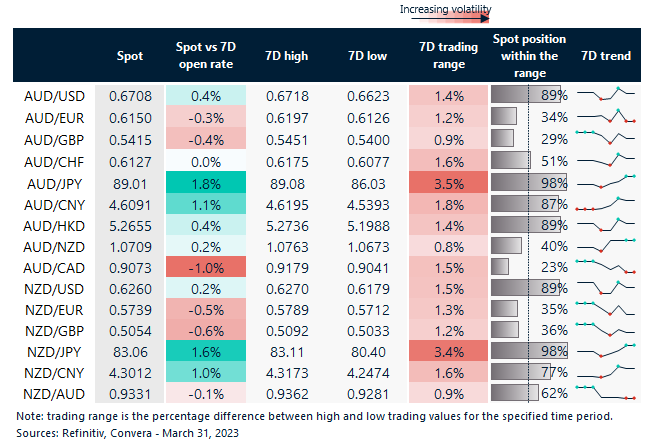

The AUD/USD gained 0.4%. The Aussie was mixed in other markets, however. The AUD/JPY gained 0.2% while the AUD/EUR and AUD/GBP both remained pressured.

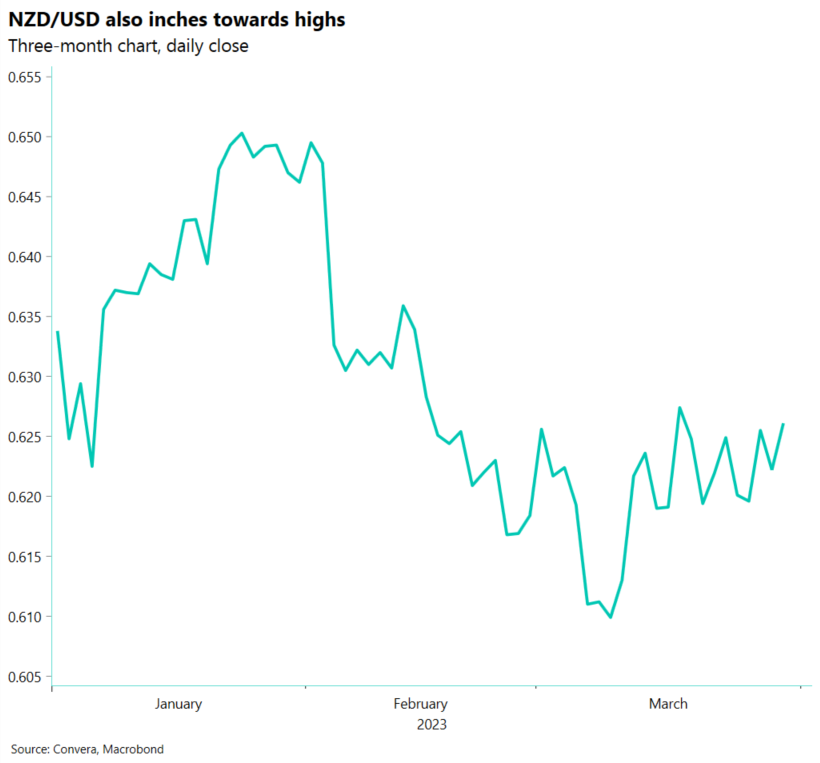

The NZD/USD climbed 0.7% and the kiwi gained versus most other major currencies.

Chinese PMI and US PCE key

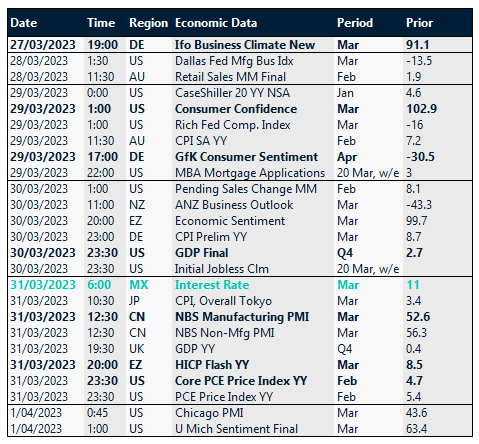

Today’s trade sees two major releases – Chinese PMI today and US PCE overnight.

The monthly Chinese purchasing manager index is released at 12.30pm AEDT. Last month, a better-than-expected reading boosted hopes for a rapid Chinese recovery and boosted the AUD.

Overnight, US personal consumption and expenditure numbers, the Federal Reserve’s favored measure of inflation, will be released.

A stronger number could mean the Fed will be forced to raise rates further and could boost the US dollar tonight.

Aussie, kiwi near top of recent ranges

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 27 March – 1 April

Have a question? [email protected]