Central banks around the world have increased their interest rates 534 times since the beginning of 2021, but markets have started positioning for the end of the global tightening cycle. All eyes now fall on the banking sector, as it will decide if central banks stop hiking or even start cutting interest rates later this year. This uncertainty is expected to induce elevated volatility across financial markets.

The banking sector driving FX

The Federal Reserve (Fed), Bank of England (BoE), and Norges Bank increased interest rates by 25 basis points last week, while the Swiss National Bank followed the European Central Bank (ECB) with a 50-basis point hike. Volatility in the fixed income space continues to be extremely elevated given the volatility of macro data and the difficulty of pricing what central bank policymakers will do next.

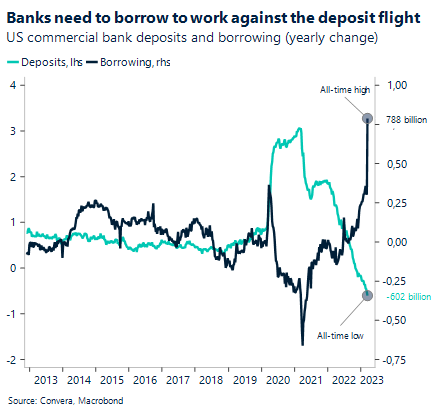

Investors are currently expecting the Fed to pause rate hikes at the next meeting, effectively ending it’s one-year long tightening cycle in May. Furthermore, money markets price in three rate cuts during the remainder of the year, bringing the fed funds rate to 4.00% – 4.25% in December 2023. This highlights the concern of investors over the recent banking turmoil. Markets don’t expect inflation to recede that easily. However, the expected tightening of lending conditions in the banking sector might substitute for the Fed’s now priced out rate hikes. Tightening will come, just not via rate hikes but by tighter lending conditions. Going into this week, focus will fall on the release of US consumer confidence, home sales, Q4 GDP and PCE inflation – the Fed’s preferred gauge for the development of inflation.

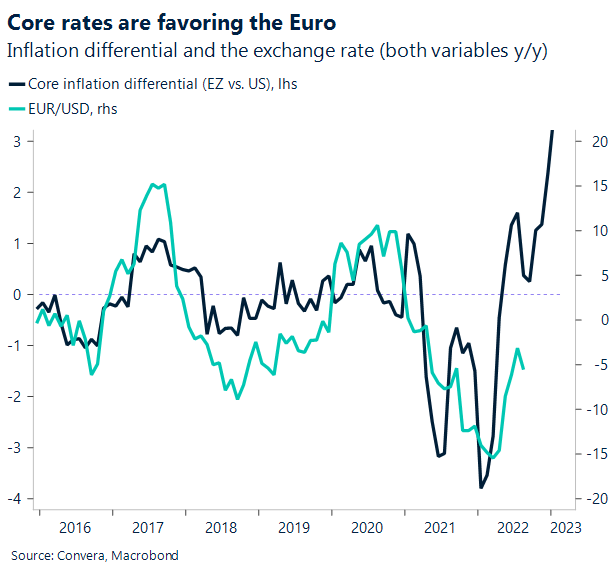

EUR/USD comes into today’s trading session ($1.0750) with four consecutive weekly gains (+2.03%), helped mainly by falling US rates and increased speculations of rate cuts coming from June onwards. We conclude that EUR/USD might benefit from the convergence of interest rates and higher core inflation rates in the Eurozone versus the US going forward, absent contagion risks in the global banking system. Under a downside scenario of spill-over effects triggering turmoil in Europe, euro upside would most definitely be limited or even completely fade.

Resilient pound tested by dovish BoE

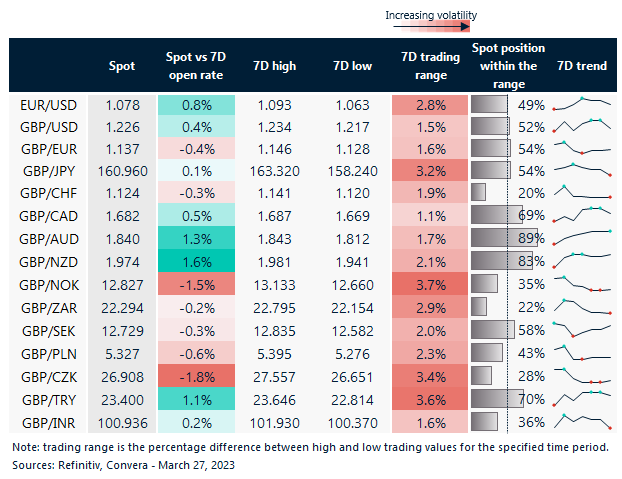

Like the euro, the pound has proved fairly resilient amid the recent banking sector turmoil. GBP/USD has risen over 3.5% from its March low, but since testing 7-week highs above $1.23, the currency pair has slipped back towards $1.22 following a somewhat dovish hike by the BoE last Thursday. The pound struggled for direction against the euro last week though following its best weekly performance the week prior. GBP/EUR is mostly contained in a tight range between its 50-day moving average (€1.1322) and its 100-day moving average (€1.1389).

The BoE hiked by 25-basis points to 4.25% – the highest since 2008 after UK inflation unexpectedly rose from 10.1% to 10.4% y/y, with core inflation also rising back above 6%. UK retail sales surprised higher in a sign of robust consumer spending despite the ongoing cost-of-living crisis and banking stress. As the BoE remains data dependent, money markets are currently pricing a 50% probability of another quarter point hike at the next policy meeting in May. This week, investors will gauge the health of the housing market with data on mortgage approvals and house prices throughout the week as well as the final fourth quarter GDP results from 2022 due on Friday. Investors will also hear from BoE Governor Andrew Bailey as he faces questions from MPs on the Treasury Committee about the collapse and subsequent purchase by HSBC of Silicon Valley Bank UK.

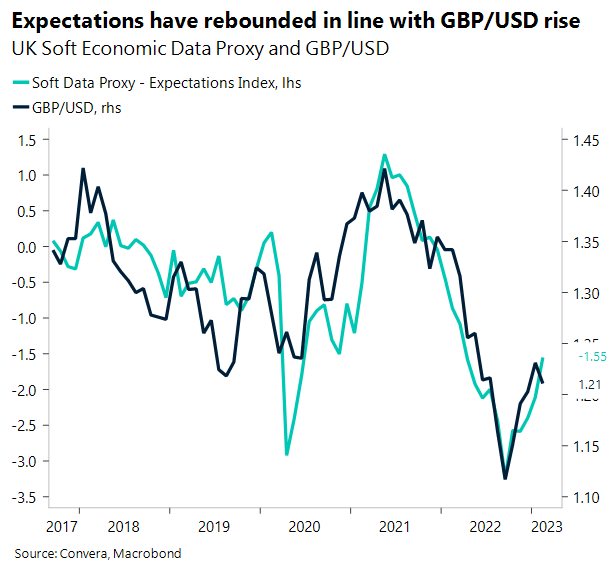

With UK recession risk receding and a decent improvement in both hard and soft economic data of late, we see this supporting a further rise in GBP/USD as evidenced by the pair’s correlation with our soft data proxy. Narrowing US-UK rate differentials also favour the pound over the dollar, particularly since US rates are forecast to fall below UK rates in 2024. There is a growing risk of contagion from the US banking crisis prompting turmoil in Europe and the UK though, which would probably limit the pound’s upside momentum.

European bank jitters wound euro

After hitting 7-week highs on Wednesday, EUR/USD dropped 2% over Thursday and Friday last week as European banking stocks plunged with Deutsche Bank and UBS Group stomaching heavy losses. Risk aversion resurfaced, with safe haven assets like gold, the Japanese yen and the US dollar benefiting.

The increasing worries about US and European lenders continues to dominate sentiment and complicate central banks’ fight against inflation. However, the ECB has retained a more hawkish rhetoric of late, reinforcing its mission to get inflation back to target. Despite mounting banking stress, the ECB remains data-driven, meaning market participants will keep a close eye on key German sentiment surveys this week as well as the flash European inflation print on Friday. Will resilient economic data and sticky inflation support the notion of two more 25-basis point hikes by the ECB and provide investors a reason to buy the euro and sell German bonds? The correlation of EUR/USD with the core inflation differential between the US and Eurozone points towards the EUR/USD rate rising if inflation does surprise higher this week. Arguments for this upside scenario should strengthen if US-Eurozone yield spreads continue narrowing.

Ultimately, the Fed is considered more likely to cut rates than the ECB under the condition that the banking stress does not spill-over into the Eurozone. Therefore, EUR/USD could break above $1.10, and be on track to touch $1.15 by year-end if these assumptions hold, particularly if the Eurozone inflation report comes in hotter than expected.

Pound pops higher after UK CPI

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: Mar 27 -Mar 31

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.