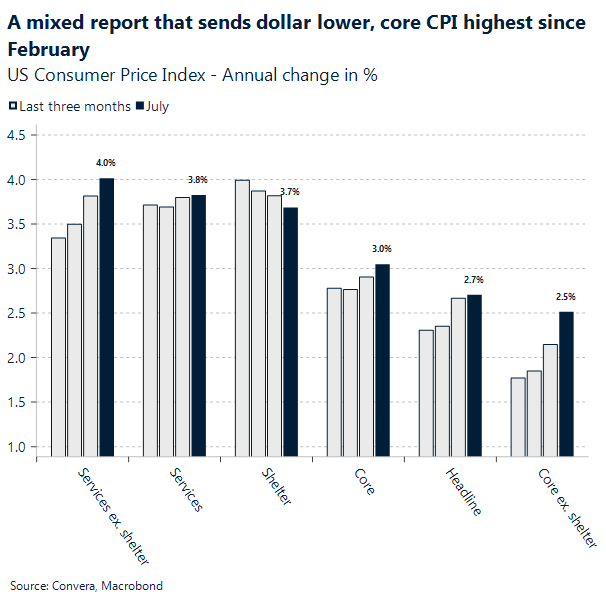

Less evident impact of tariffs in July’s CPI

US July Consumer Prices Rise 2.7% Y/Y; Est. +2.8%.

US July Core CPI Rises 0.3% M/M; Est. +0.3%.

The year-on-year core CPI has now accelerated to 3.1%, a figure that’s slightly higher than anticipated and takes the measure back to its highest point since February. This is particularly significant given that Chair Powell has emphasized that policymakers are focused on 12-month inflation figures.

While new vehicle prices were flat and used cars and trucks saw a modest 0.5% increase, it’s also notable that prices for food at home remained unchanged this month. Interestingly, the impact of tariffs seems to be less evident in July’s data than in June’s. Core goods, excluding new and used vehicles, were up just 0.22% in July, a significant slowdown from the 0.55% advance in June, a figure that had been the highest since the peak of pandemic inflation in early 2022. Looking at specific categories, household furnishings, which economists have been watching for tariff effects, saw a monthly gain of 0.7%, a slight slowdown. However, the 2.4% year-on-year increase is a two-year high for the category. Similarly, video and audio products, another closely watched category, saw a monthly rise of 0.8%, their smallest increase since May. While this may not sound like much, the 0.4% year-on-year increase is the biggest gain for this category since 2021.

The impact of tariffs on inflation appears to be a slow burn rather than a sudden spike, concentrated narrowly within the goods sector. Outside of this, broader inflationary pressures seem manageable, which is a positive sign for the Federal Reserve. However, while much attention is on goods prices and tariffs, it is noteworthy that services has been trending upwards on a year-on-year basis.

The market’s immediate response to the inflation report suggests some traders had anticipated a more negative outcome. Treasuries rallied, causing two-year yields to fall, as traders increased their bets on a Federal Reserve rate cut next month. The dollar tumbled, while S&P 500 futures climbed. This shift in sentiment was also reflected in interest-rate swaps, which showed traders pricing in an almost 90% probability of a quarter-point rate cut at the September policy meeting, a significant jump from the 74% probability estimated before the report’s release.

Pound steady after UK jobs data

Sterling edged slightly higher against the U.S. dollar this morning following the UK labour market release, though FX markets responded with little urgency as the data broadly matched expectations. Wage growth slowed more than forecast, with weekly earnings rising 4.6% versus 4.7% expected and down from 5% previously. Unemployment held steady at 4.7%, while headline wage growth excluding bonuses remained elevated at 5%, offering a clearer view of underlying pay pressures. Private sector earnings eased to 4.8%, and payrolled employee numbers declined for a sixth consecutive month – the worst stretch since the pandemic.

Additional signs of labour market softening came from a continued drop in job vacancies, now falling for the 37th straight period. The vacancy-to-unemployment ratio also declined, suggesting a less tight labour market as more workers are available to fill open roles. While these indicators point to easing conditions, wage growth remains above levels consistent with the Bank of England’s (BoE) inflation target.

Taken together, the data supports the BoE’s hawkish hold last week, reinforcing the view that rate cuts may remain off the table for now. With elevated pay growth sustaining inflation concerns, the yield channel continues to offer support for the pound – though its durability will depend on how quickly wage pressures ease in the months ahead.

U.S.-Canada softwood dispute escalates

The current trade dispute over softwood lumber between the U.S. and Canada is not a new phenomenon, but rather the latest chapter in a conflict that has simmered for decades, with roots stretching back to the early 1980s. The dispute originated with a fundamental difference in how the two countries manage their forests: in Canada, the majority of timberland is publicly owned and managed by provincial governments, while in the U.S., most is privately held. American lumber producers have long argued that Canada’s system of setting “stumpage fees”, the price paid to harvest timber, at what they claim are artificially low rates, constitutes a government subsidy. This, they assert, gives Canadian companies an unfair advantage, allowing them to sell their lumber in the U.S. at below-market prices and harm the American industry. Multiple attempts at a resolution, including the 1996 and 2006 Softwood Lumber Agreements, have provided temporary truces, only to expire and lead to the resumption of hostilities, as is the case today.

The economic fallout from these duties is not distributed evenly across the U.S., but disproportionately affects states and cities with high demand for new housing. The tariffs directly increase the cost of construction materials, squeezing profit margins for builders and ultimately raising home prices for consumers. This impact is most acutely felt in booming housing markets across the South, Southwest, and Pacific Northwest. States like Florida, Texas, and California, which are experiencing rapid population growth and a persistent housing shortage, are particularly vulnerable. In these regions, where new home construction is a critical driver of the local economy, the tariffs serve as an added headwind to an already challenging affordability crisis.

The recent announcement by the Canadian government to provide new financial support, including loan guarantees and grants for its forestry sector, is seen by the U.S. Lumber Coalition as an escalation of the trade conflict. According to Zoltan Van Heyningen, the coalition’s executive director, this aid package is essentially a new subsidy that not only fails to mitigate the existing duties but could also lead to further increases. This perception highlights a key point of “fault” from the U.S. perspective: Canada’s government structure and policies are viewed as enabling and perpetuating unfair trade practices. From the American viewpoint, these government-backed interventions confirm their belief that Canada is actively undermining fair trade principles, providing continued justification for the punitive duties. This ongoing tit-for-tat dynamic, with each side escalating measures in response to the other, adds another layer of complexity that puts on hold any hopes for a comprehensive trade deal between the two countries, which for decades has been seen as an elusive but necessary resolution to this decades-old dispute.

The market’s immediate response to the inflation report suggests some traders had anticipated a more negative outcome. The CAD has rallied from 1.38 to 1.377, as traders increased their bets on a Federal Reserve rate cut next month. The dollar tumbled, while S&P 500 futures climbed. This shift in sentiment was also reflected in interest-rate swaps, which showed traders pricing in an almost 90% probability of a quarter-point rate cut at the September policy meeting, a significant jump from the 74% probability estimated before the report’s release.

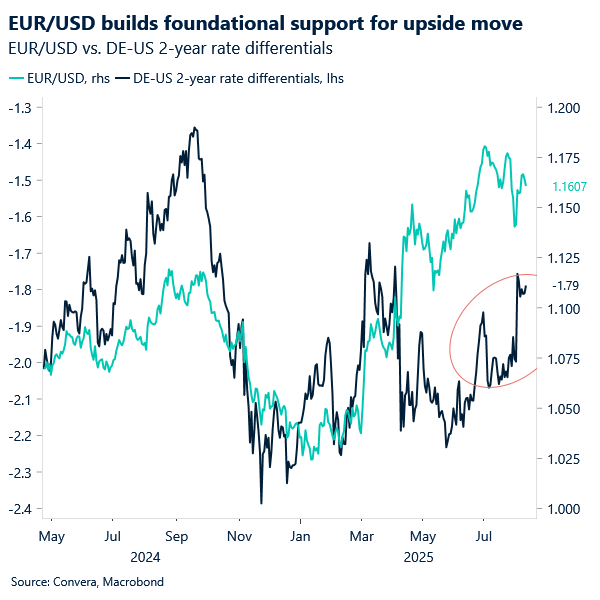

Rangebound with upside risk

EUR/USD dipped yesterday to test support at $1.1600, delineating the contours of a range it has been stuck in for several days: $1.1600–1.1670. Following the major US labor market fiasco – and the Trump-esque response that saw the head of the BLS removed – the euro found momentum to push higher. It is now up 1.7% month-to-date. However, investor confidence in the eurozone’s ability to secure a trade deal that proportionally benefits the bloc remains damaged.

From a sentiment perspective, therefore, this creates a less-than-rosy outlook for both currencies, reinforcing the need for concrete catalysts to drive the euro higher amid structural dollar weakness. In the absence of such events, quiet trading days tend to leave the pair directionless.

Still, the balance of risks remains tilted to the upside for EUR/USD in the short term. Fundamentally, the pair has support, which bolsters sentiment-driven factors in favor of the euro—especially during periods of recovery. In fact, two-year EUR/USD rate differentials have narrowed to their tightest levels this year, reflecting expectations that the Fed may soon resume rate cuts.

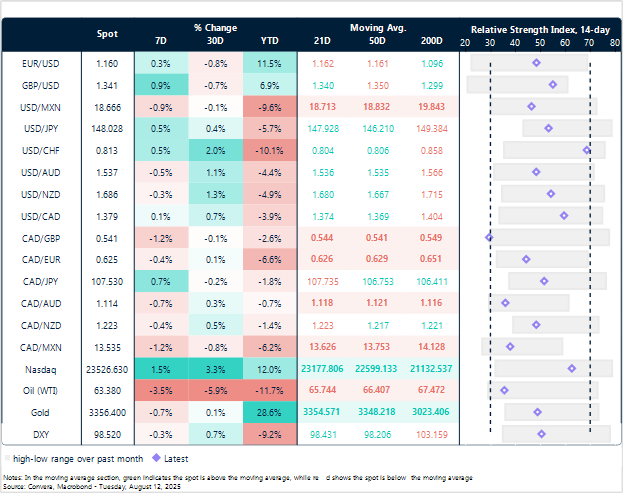

Traditional safe havens under pressure

Table: Currency trends, trading ranges and technical indicators

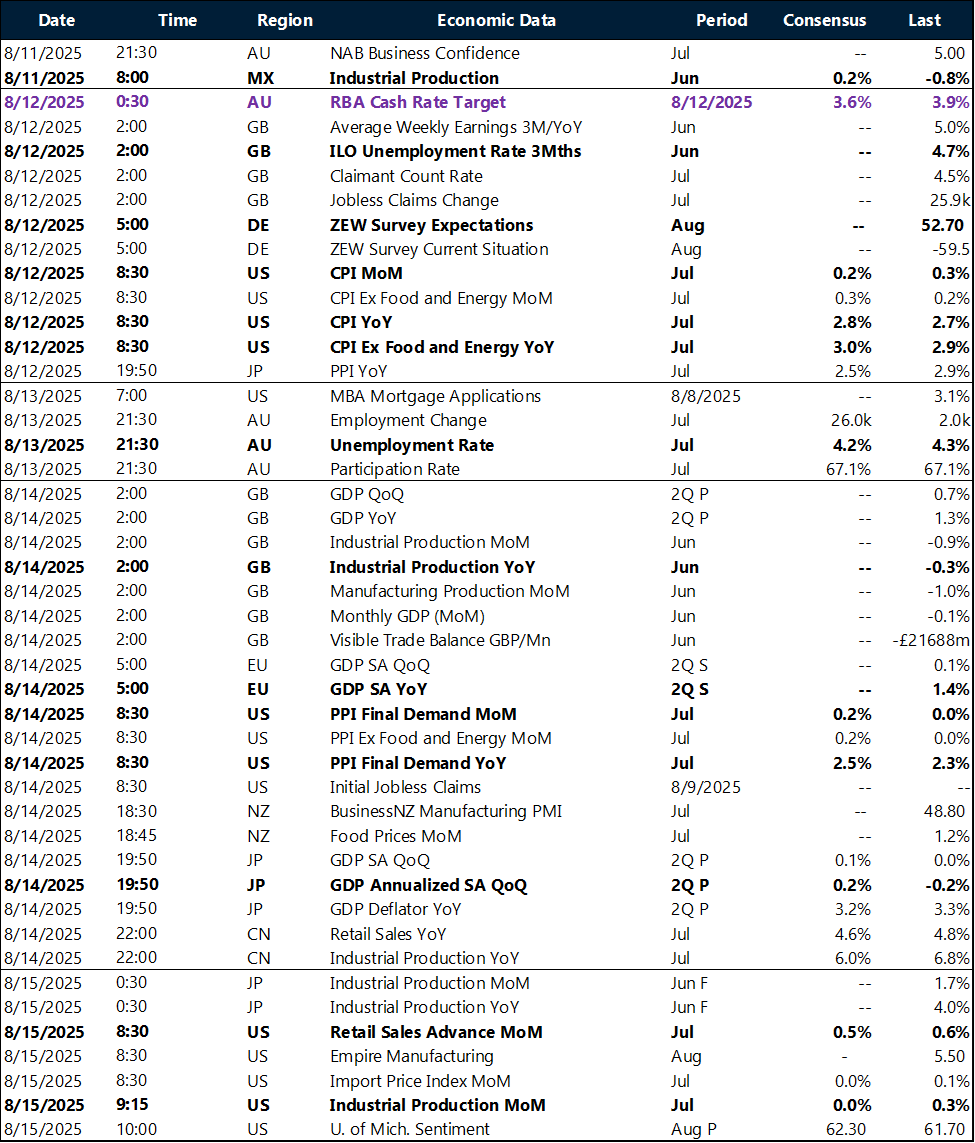

Key global risk events

Calendar: August 11-15

All times are in ET

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.ve a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.