Written by Convera’s Market Insights team

Volatility erupts on Iran-Israel conflict

George Vessey – Lead FX Strategist

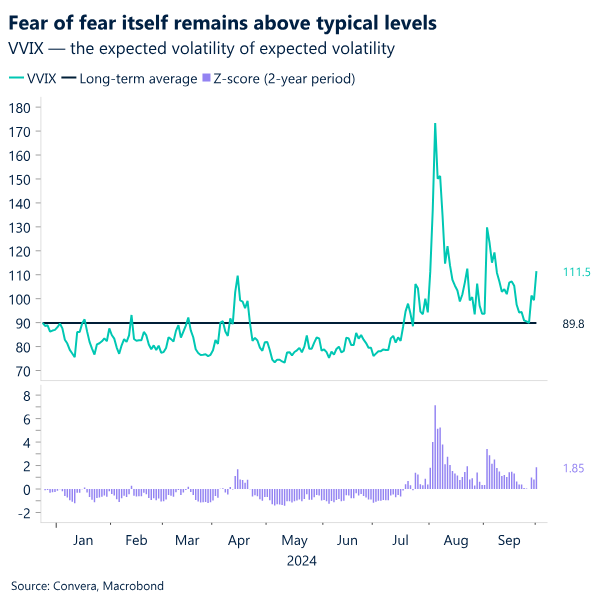

A spike in geopolitical risks triggered a surge in safe haven demand yesterday. Gold, bonds and the USD, JPY and CHF all rallied, whilst equities and risk-sensitive currencies, like GBP, tumbled. The VIX index, Wall Street’s so-called fear gauge, jumped back above its long-term average, hitting a key level that usually indicates more volatility ahead. Another sign of anxiety that is closely watched by traders is the VVIX – the expected volatility of expected volatility – because this has remained above its long-term average for several months now.

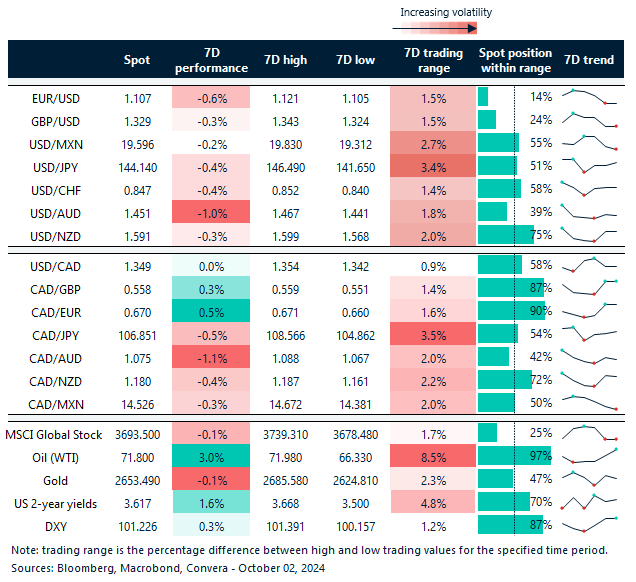

Tensions in the Middle East have been escalating all year, but markets have been relatively indifferent, focusing instead on macro and monetary developments. But it was a report yesterday that the US was actively supporting preparations to defend Israel against a ballistic missile attack, that spurred a flight to safe haven assets. Within hours, Iran fired a barrage of around 200 missiles, which immediately promised an Israeli response. The magnitude of Israel’s retaliation will determine the how much more geopolitical risk is priced in by markets. Oil prices have already spiked 5% as the risks of a wider conflict grow. Given how short speculative positioning has become in oil, this rally could have legs if those shorts unwind. Currencies of oil-exporting nations, such as the NOK and CAD strengthened as a result of surging oil prices, with GBP/CAD down over 1% on the day.

Volatility has been extremely subdued for most of the past two years, but the bouts we’ve had over the past couple of months are a potential warning signal that we have moved into a new regime – especially with geopolitical risks mounting and the US election looming. This doesn’t bode well for the risk-sensitive pound, which has already fallen two cents from its 31-month high reached against the US dollar last week.

Mixed US data keeps another 50 in play

George Vessey – Lead FX Strategist

A slew of mixed US data yesterday failed to alter the risk off tone in financial markets, as the US dollar index rose to its highest in three weeks. It’s crucial to keep on top of US data though, as markets continue to price in a high probability of another 50 basis point cut by the Federal Reserve (Fed) before year-end.

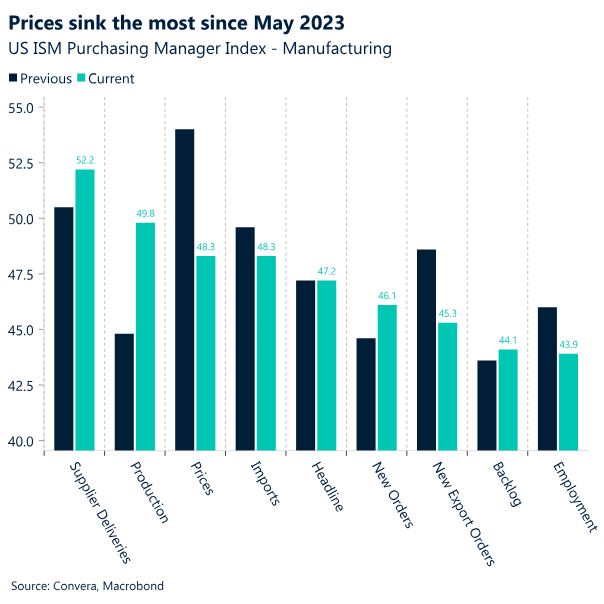

US manufacturing activity shrank in September for a sixth month, reflecting weak orders and declining employment. The prices-paid index fell 5.7 points, the most since May 2023, to 48.3, the first time this year that the gauge has indicated decreasing overall costs. The survey was conducted before a strike at East and Gulf coast ports though, the first in nearly 50 years, and this could potentially push up shipping costs and import prices in the future. Hence with oil prices surging higher and supply chain disruption concerns mounting, inflation worries might start remerging soon. Moreover, despite the weak employment index in the PMI survey, a higher number of job openings from the JOLTS report eased labour market concerns. This might all mean the Fed slows the pace of easing.

Earlier this week, Fed chair Jerome Powell cooled speculation of a second jumbo cut, indicating that two more quarter-point rate cuts by year-end was a base case. The comments reined in rate futures prices to show just 70bps of Fed cuts by the end of the year, down from more than 75bps earlier. Yesterday’s mixed data was overshadowed by escalating tensions in the Middle East, but it also means Friday’s payrolls report is going to be the decisive factor for another large cut in November or not.

Eurozone inflation drops below 2%

Ruta Prieskienyte – Lead FX Strategist

The euro retreated amid rising geopolitical tensions in the Middle East and a preliminary report indicating that Eurozone inflation has slowed below the ECB)’s2% target for the first time since 2021. European stocks sold off, while bonds rallied in response to the risk-off sentiment. The back end of the German sovereign yield curve saw aggressive buying, resulting in a bull flattening, with the 2-10 year spread narrowing to approximately 2.4 basis points, a one-week low.

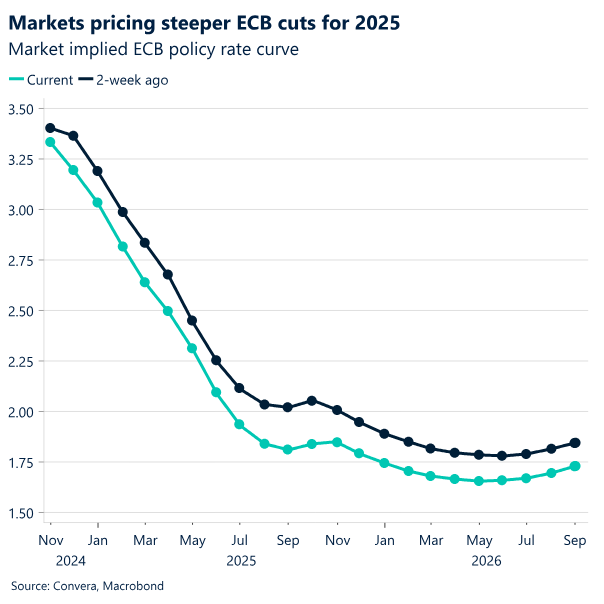

In September, consumer prices rose by 1.8% year-on-year, down from 2.2% the previous month, largely due to a sharp drop in energy costs. Energy prices continued to decline, and inflation slowed for services (4% versus 4.1%), although prices for food, alcohol, and tobacco rose slightly. Core inflation also eased to 2.7%, down from 2.8%. Despite this cooling, the ECB expects inflation to rise again in the latter part of 2024 as the sharp falls in energy prices fall out of the annual comparison. However, the recent downside miss relative to the ECB’s inflation target has led investors to increase rate cut expectations. With an October rate cut almost fully priced in (23 basis points), market participants are now extending rate cut bets further along the curve. The 2-year Bund yield dropped below 2% for the first time since 2020, with a rate cut now priced in for every ECB decision until May 2025. The implied terminal rate has fallen below 1.65%, hitting a multi-month low.

This dovish outlook has reawakened euro bears, causing the EUR/USD to drop below the short-term support level of $1.11, hitting a two-week low. The broader Euro index also declined, particularly against safe-haven currencies. If the current momentum continues, EUR/USD could slide further towards the 50-day moving average of $1.1036 in the near-term.

In other developments, French PM Michel Barnier delayed the target to bring the country’s budget deficit within the EU’s 3% limit by two years, to allow more time to address public finances. Barnier warned that the deficit could expand beyond 6% this year. The market reacted negatively to this announcement, with the yield on French 10-year bonds rising from an intraday low of 2.78%. The CAC 40 fell 1%, though this was also influenced by headlines concerning an imminent Iranian attack on Israel. Consequently, the 10-year OAT-Bund spread widened by 4 basis points, reaching 78 basis points.

Oil rallies amid Mideast unrest

Table: 7-day currency trends and trading ranges

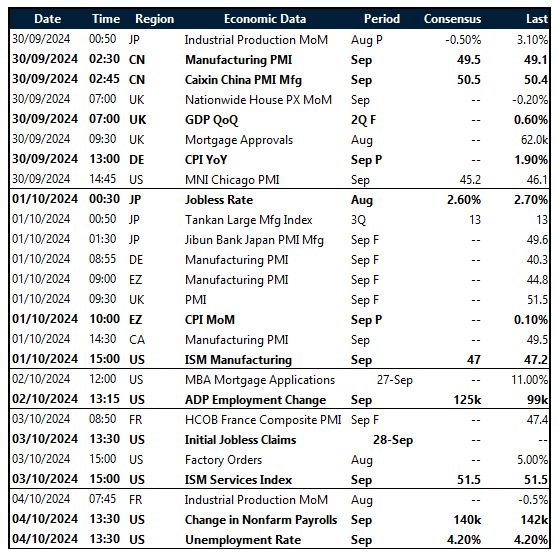

Key global risk events

Calendar: September 30-October 04

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.