Written by Convera’s Market Insights team

Risk on, risk off; geopolitics in focus

George Vessey – Lead FX Strategist

Risk sentiment briefly improved after a period of risk aversion tied to the escalating Russia-Ukraine conflict. However, when news broke that Russia fired an intercontinental ballistic missile at Ukraine for the first time since it invaded, investors fled to safety once again. The USD is gaining against European currencies, but the Japanese yen is the clear winner, up almost 1% against most peers, including the buck. The rise in oil prices has supported currencies of oil-exporting nations though, such as NOK and CAD. European stocks and US futures turned lower, though Bitcoin continues to close in on the $100,000 mark.

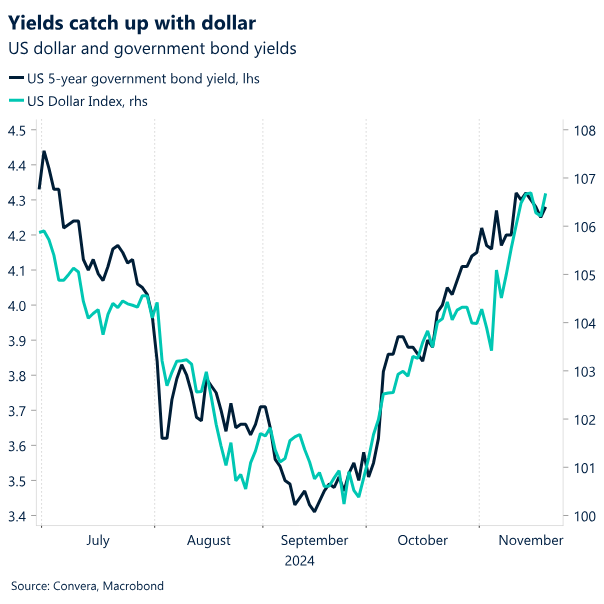

Aside from geopolitical jitters, investors have also refocused on prospects for the US economy, and amidst the better-than-expected economic data over recent weeks, along with a Republican sweep of the presidential and congressional elections, the US exceptionalism narrative remains in full swing. The benchmark 10-year Treasury yield is up roughly 80 basis points from its 52-week low in mid-September and thus the dollar’s rally has been turbocharged by the revival of the Trump trade via the likely shift in fiscal and monetary policy. The US’ economic strength and upgraded GDP expectations contributed to significant dollar gains in 2024 and that could extend in early 2025.

However, we are conscious there are still several uncertainties lingering including the timing of fiscal and tariff policy implementation, what the response from US peers could be and whether US economic data confirm an outperforming economy. Moreover, weak seasonals in December for the dollar might be a brief opportunity for other currencies to claw back some lost ground.

Testing the $1.05 handle

George Vessey – Lead FX Strategist

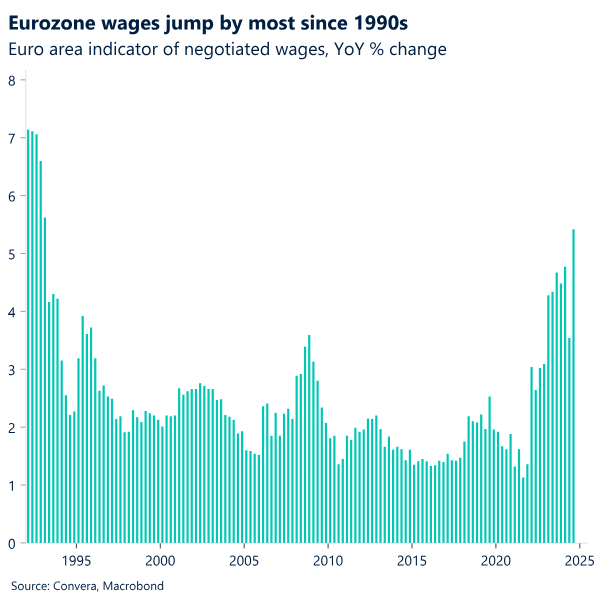

The euro has dropped sharply back to $1.05 against the US dollar, shedding almost 1% amidst rising geopolitical risks, trade risks and widening rate differentials to the euro’s disadvantage. This has occurred despite a key gauge of Eurozone wages having jumped by the most since the 1990s, which complicates the European Central Bank’s (ECB) easing plans as inflation cools.

Third-quarter negotiated pay rose 5.4% from a year ago, up from 3.5% in the previous three months and was largely driven by Germany. Growth in wage deals is closely watched by the ECB as a signal of persistent inflationary pressures, however a weakening of companies’ pricing power along with the frail economic backdrop will keep the easing cycle intact. Investors currently expect the ECB to cut interest rates by 139 basis points by the end of 2025 but ECB officials have been downplaying the likelihood of aggressive rate cuts. In light of this divergence, euro interest rate volatility is likely to increase into next year.

In the FX options space and as the common currency hovers near its 2024 low, traders increasingly expect a weaker euro heading into year-end and if we see a break of the $1.05 handle, then this would open the door to potentially $1.03, which was our downside target this year in the event of a Red Sweep US election outcome. Geopolitics could aid such a move. An escalation in the Russia-Ukraine war would be an additionally strong headwind on top of everything else dragging the euro lower.

Pound erases inflation gains

George Vessey – Lead FX Strategist

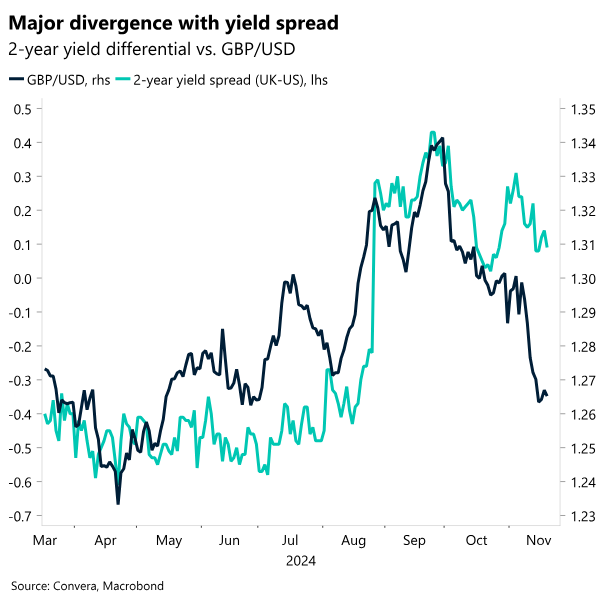

Sterling surrendered all of its post-inflation gains versus the US dollar and more, falling back into negative territory for the year and down over 2% month-to-date. GBP/USD remains about two cents below its 5-year average at the moment, having been six cents above it less than two months ago. This is down to the Trump effect. GBP/EUR, on the other hand, has reclaimed €1.20, and is up over 4% year-to-date and five cents above its 5-year average.

The cyclically-driven GBP bullish view that’s been in place since early 2024 could extend into 2025 if UK economic data remain robust and inflation keeps surprising higher, forcing the Bank of England (BoE) to delay rate cuts. It’s unclear how long this dynamic could play out though. The October UK Budget means a shifting fiscal-monetary policy mix, which was initially seen as supportive for sterling, yet focus might turn to the propensity of tax hikes to curb consumption and overall economic performance. In turn, if the UK economy starts to underwhelm, sterling is likely to weaken. Flash industry PMIs will be published tomorrow to gauge the health of the economy in this final quarter of the year.

In terms of the BoE, we now expect no change to rates in December’s meeting. The central bank will most likely continue its “gradual” rate-cutting path for now, which is widely taken to mean one cut per quarter. Thus, with money markets only pricing in around 60 basis points of reductions by the end of next year, there remains plenty of room for traders to catch up with that view and for sterling to correct lower.

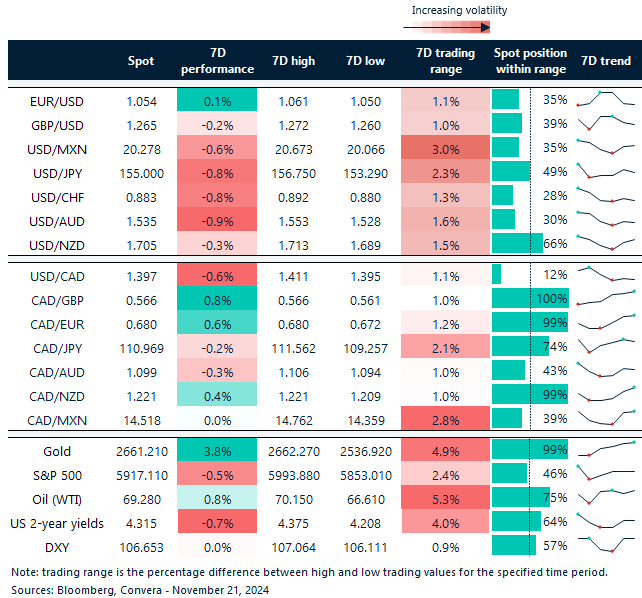

Gold climbs almost 4% on geopolitical fears

Table: 7-day currency trends and trading ranges

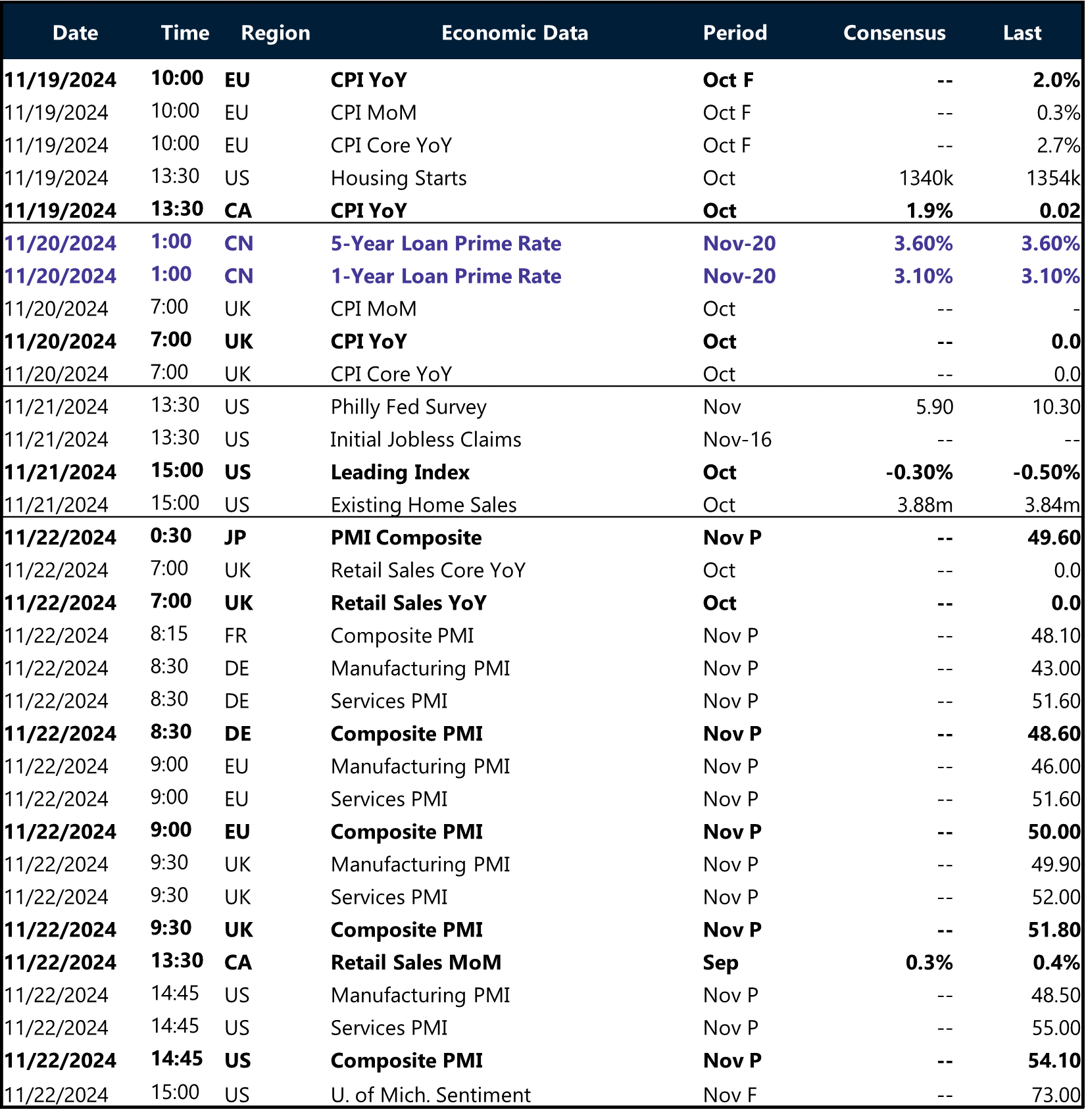

Key global risk events

Calendar: November 18-22

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.