Greenback comeback helped by jobs

The US dollar ended last week higher after the key US non-farm payrolls report beat expectations, albeit moderately.

The November jobs report found 199k new jobs were added last month, above the 180k forecast. The unemployment rate fell from 3.9% to 3.7%.

Friday’s report contradicted other labour market data received last week with the JOLTS job openings and ADP employment reports both missing forecasts.

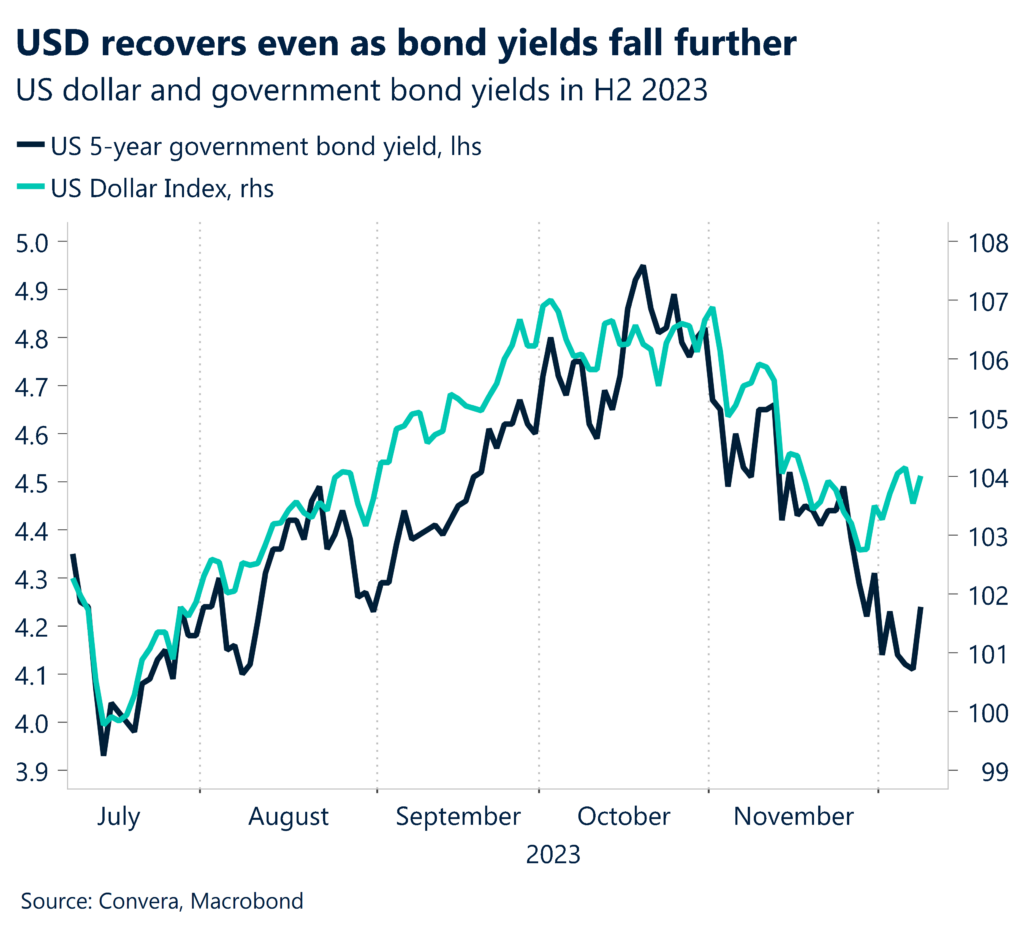

The greenback gained, continuing to recover from its steep losses in November, with the USD index climbing to three-week highs on Friday.

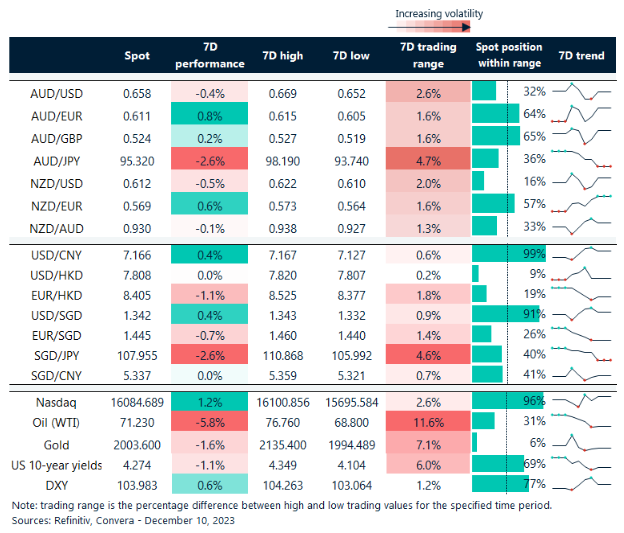

The Australian dollar was mostly lower last week after the Reserve Bank of Australia kept interest rates on hold. The AUD/USD fell 0.4% on Friday.

In Asia, the USD/SGD and USD/CNH both bounced to three-week highs.

The kiwi led losses with the NZD/USD down 0.8% on Friday.

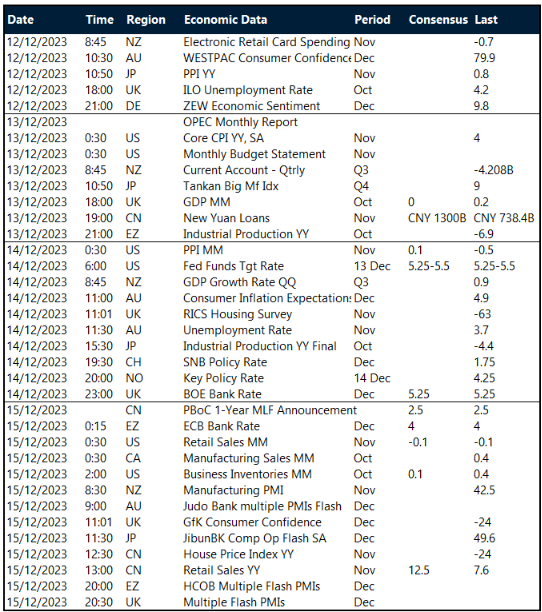

Looking forward, we have a major week for decisions from central banks, with the US Federal Reserve, European Central Bank and Bank of England all due.

US services sector stays strong

The USD was helped by other strong data. The ISM services survey’s headline composite rose from 51.8 in October to 52.7 in November, which was a little improvement over forecasts.

In November, the employment index increased by 0.5 points, the new orders index remained constant, and the business activity indicator increased by 1.0 points. Although the report’s overall findings indicate that the services sector has firmed somewhat in the most recent month, the headline and several important component levels still appear lacklustre.

In the medium term, the USD’s recent strength might continue, with DXY index support level at 103 and momentum indicators like relative strength index signalling the potential for a bounce.

China underperformance continues

In China, the ongoing struggles in manufacturing continue. November’s NBS manufacturing PMI decreased by 0.1 percentage points to 49.4, mostly due to lower production (50.7) and new orders (49.4).

However, the Caixin Manufacturing PMI increased by 1.2 percentage points to 50.7, the highest level in the previous three months. The non-manufacturing PMI for NBS fell by 0.4 percentage points to 50.2, remaining above 50 since January 2023. Specifically, as the October holiday effect subsided, the services PMI fell by 0.8 percentage points to 49.3.

While a path of lower USD/CNY is likely by reducing external drags and persistent decline in core yields, for CNY FX, a constrained growth impetus would necessitate embedding a risk premium. That said, we turn neutral on USD/CNY from bearish stance.

USD higher for the week after stronger NFP jobs

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 11 – 15 December

All times AEDT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.