Labour market trumps leading indicators

Global risk sentiment took a dive in yesterday’s session, following stronger than expected US labour market data which pushed back expectations for the first rate cut by the Federal Reserve (Fed) from January to March 2024. Markets have been pretty convinced about the US central bank ending its more than a year long tightening cycle in July. However, the date of the first easing of policy has continued to shift drastically in recent weeks given the divergence between falling inflation rates and resilient macro data.

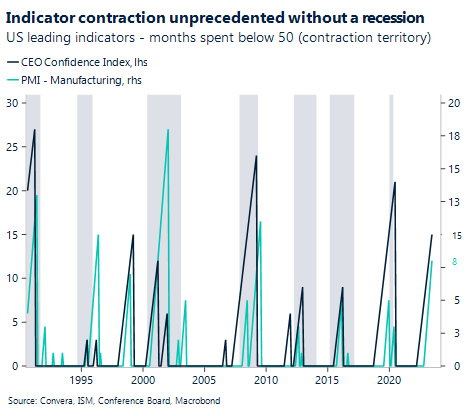

Looking at yesterday’s macro data, initial jobless claims continue to show resilience. The number of Americans filling for unemployment benefits fell from 237 to 228 thousand in the week ending July 15th. This was the lowest level in two months and goes against the overall upwards trend that had started in October last year. Not all data points have been surprising to the upside. The Conference Board’s Leading Economic Index continued to show weaker economic activity and has now been in negative territory for 15 consecutive months. Existing home sales also fell by 3.3% to 4.16 million units sold in June on an annual basis, the lowest level since January.

Macro data has come in mixed in recent weeks, but the strong labor market has been overshadowing any weakness in other leading indicators. Investors have preferred looking at inflation for gauging where the Fed will go but with price pressures continuing to fall, the labor market might be what starts moving to the centre in the coming months. The US Dollar Index pushed higher, rising in four out of the last five sessions. The trade weighted index is symmetrically positioned, being down around 12% from its 20-year high reached in October and about 12% up from its pre-Fed hiking cycle level.

Pound bounces after upbeat retail sales

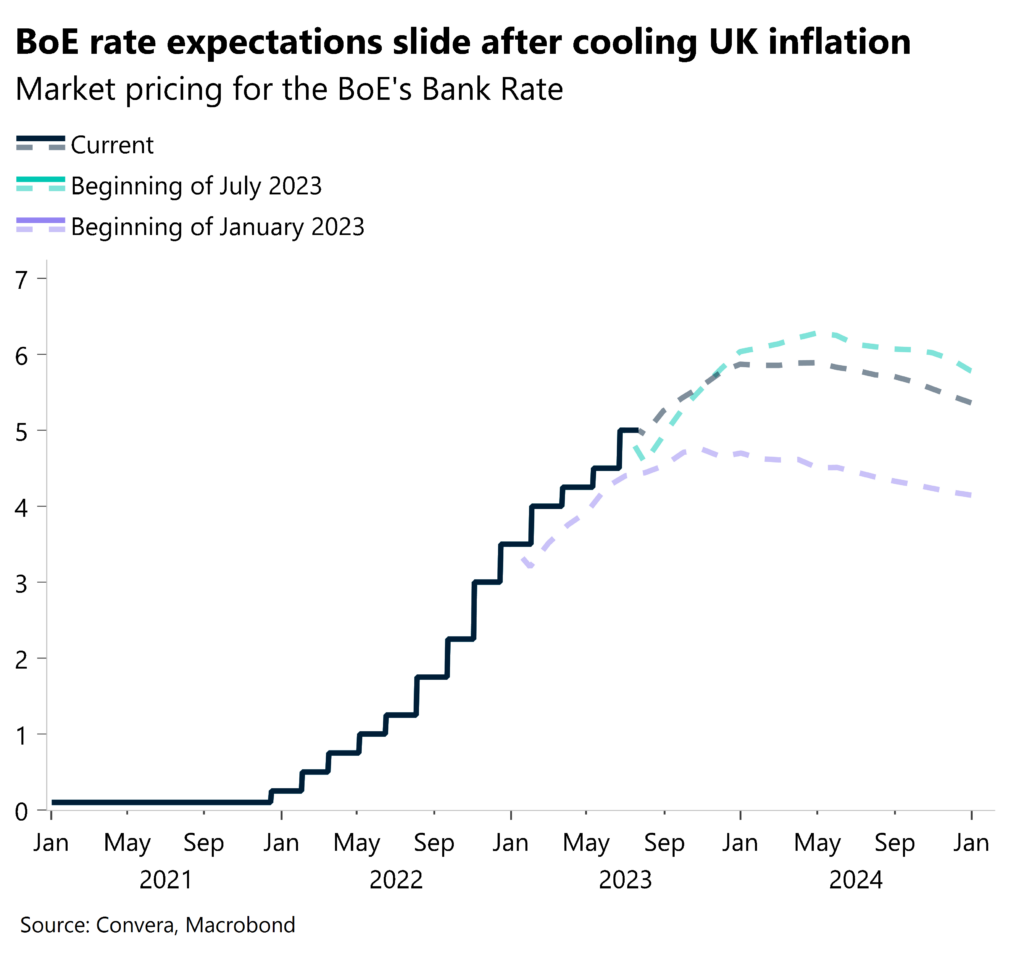

Sterling was heading towards its biggest weekly decline against the US dollar since January following the repricing in UK rate expectations after the below-forecast inflation print this week. However, the pound has modestly bounced this morning after data showed UK consumer spending was stronger than expected in June, which is a blow to doves advocating a 25-basis point Bank of England (BoE) hike next month.

After trading in overbought conditions following a huge shift in UK rate expectations earlier in the month, the negative catalyst for the pound and rates was the cooler UK inflation figures this week. Markets are now pricing in a sub-6% peak rate versus 6.5% a fortnight ago, while declining bets on a 50-basis point hike in August have diminished the probability of such a move to 28%. As the disinflation theme gains traction, sterling upside may further waver as it loses its yield appeal amidst a converging rate outlook. Still, signs of economic resilience will feed into the BoE’s narrative that the consumer can handle higher interest rates, therefore today’s UK retail sales data has thus cushioned sterling’s multi-day drop. UK retail sales rose by 0.7% in June from May, crushing forecasts for an increase of 0.2%, while year-on-year, they fell 1.0%, compared with expectations for a decline of 1.5%. However, the GfK consumer confidence indicator fell for the first time in six months as persistent inflation and rising interest rates continued to weigh on sentiment, which may see spending impacted in the months ahead.

GBP/USD is grappling with $1.29 this morning after touched a 16-month peak last week, whilst GBP/EUR floats in the mid-€1.15 area. Today’s data might not be enough to support sterling climbing much higher ahead of the key central bank meetings (Fed and ECB) next week.

Euro eases, ECB in focus next week

The euro has fallen towards the $1.11 level against the US dollar after consolidating in a tight range above $1.12 for several days. As well as resilient US data helping the dollar, some European Central Bank (ECB) officials stated that there is no consensus on whether more rate hikes will be warranted for September under the current macroeconomic backdrop. This dovish rhetoric wounded the common currency.

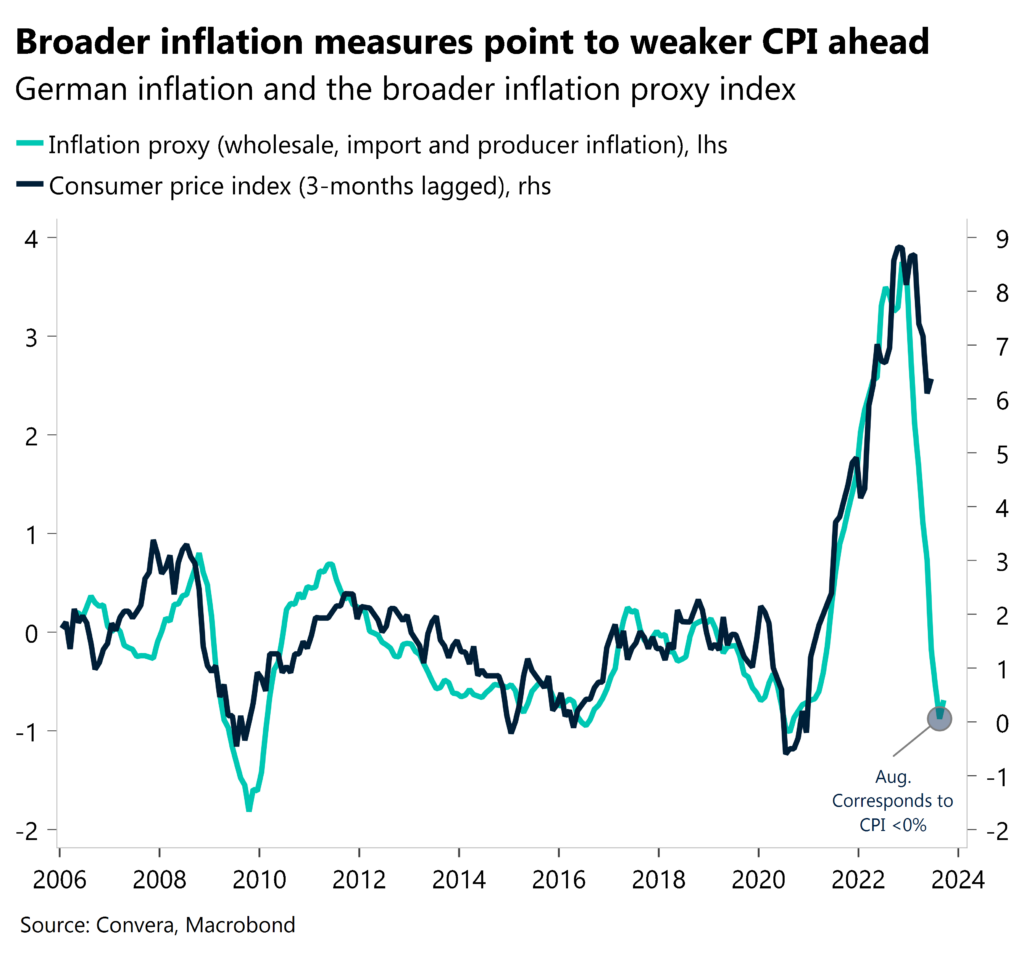

Inflation in the Eurozone declined to a 17-month low of 5.5% in June, but the core rate remained stubbornly high at 5.4%, still close to the all-time high of 5.7% seen in March. Yesterday, annual producer inflation data in Germany showed prices slowed to 0.1% in June, the lowest since December 2020, compared to 1% in May and market estimates of a flat reading. Producer prices are considered a precursor to the development of the cost of living, so pay pressures on consumers should continue to improve. Indeed, consumer confidence across the bloc is slowly but steadily recovering towards its long-term average, whilst new data showed that the Eurozone economy stalled in the first quarter of the year, revised from earlier estimates that showed a slight contraction.

With a quarter-point interest rate rise from the ECB fully expected next week, the euro’s focus will be on clues as to the likelihood of another hike in September. Overall risk sentiment, equity differentials and positioning are currently doing the heavy lifting in explaining FX, but if it looks like the ECB will hike again in September, this could spur a move towards $1.13 against the dollar and drag GBP/EUR towards €1.14 in the short term.

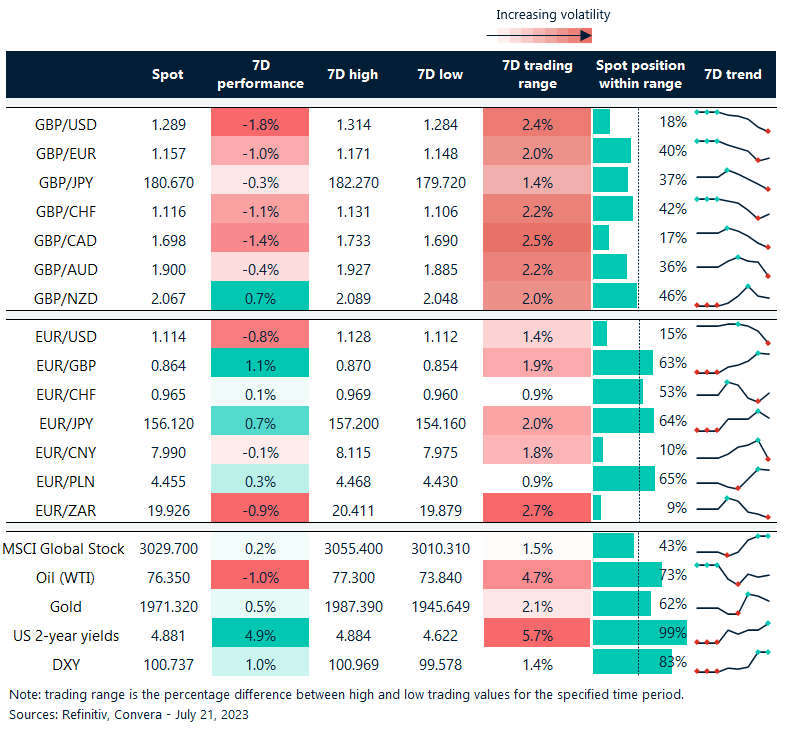

Over 2% range in GBP pairs this week

Table: 7-day currency trends and trading ranges

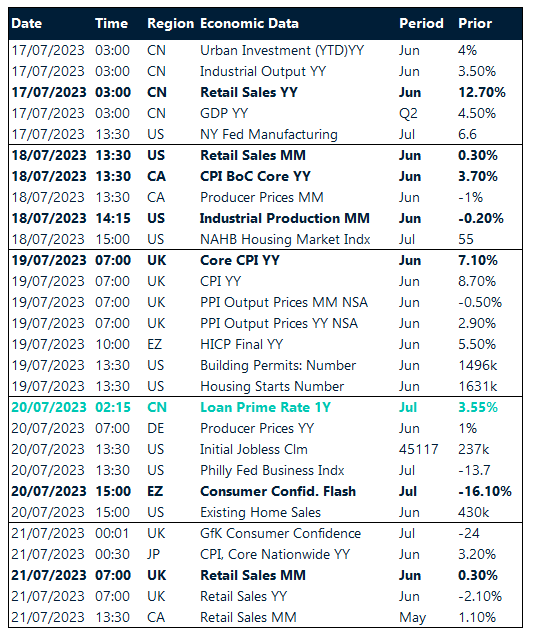

Key global risk events

Calendar: July 17-21

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.