Written by Convera’s Market Insights team

Check out our latest Converge Market Update Podcast where our Global Macro Strategist, Boris Kovacevic, breaks down this week’s most notable macroeconomic news.

Dollar hit by series of weak data

Boris Kovacevic – Global Macro Strategist

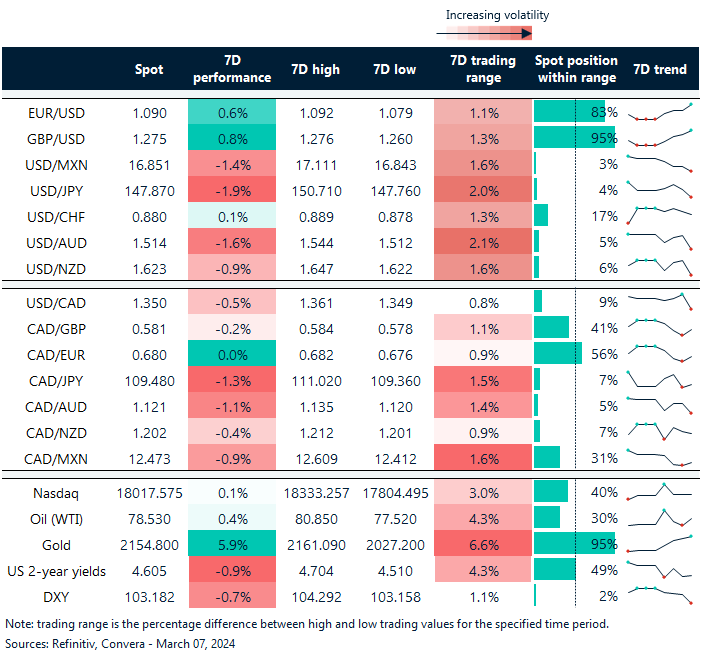

The US dollar suffered its worst day in a month and is on track to record its worst week so far this year amid a series of macro disappointments that have added another 25 basis point rate cut to the markets Fed pricing for 2024. The spree of downside surprises started with last week’s purchasing manager index for the manufacturing sector, which came in lower than expected (47.8 vs. 49.5) and therefore stayed in contractionary territory for the 16th month. The Institute for Supply Management published its other barometer for the services sector on Tuesday. The headline index came in below forecasts with the employment sub-index falling into contraction.

This has put particular attention on yesterday’s labor market data, which failed to ease investors’ worries about the loss of momentum. Both job openings (JOLTS) and the ADP private employment report came in short of the consensus number economists had been looking for. Job openings fell from 8.88 million to 8.64 million as the quits rate continued falling from 3.44 million to 3.38 million. Anecdotal evidence of the easing of labor market conditions had been present before. However, the recent data has added to concerns of job growth slowing in the US. The Fed’s economic report (Beige Book) saw the tight employment situation ease as well last month as consumer spending inched lower.

The trading day came to an end with Fed Chair Jerome Powell testifying before lawmakers, as the Fed chief tried to walk a fine line between confirming policy easing expectations for this year, while cautioning on declaring victory over inflation too soon. Cutting interest rates will only be considered appropriate once the FOMC has gained greater confidence that inflation is moving sustainably towards 2%. However, the progress on the inflation front has been noted and could make the June meeting the beginning of the easing cycle.

Attention is now turning to the non-farm payrolls report coming out on Friday. The US dollar has lost significant momentum in recent trading sessions and is only up against 8% of global currencies month-to-date. This is down from 43% in February and 73% in January. The Greenback is down to a year-to-date gain of below 2% but is still trading above the 103.00 handle, which could be tested based on the current Fed pricing. Going into the last two trading days of the week, only a dovish ECB or stronger non-farm payrolls report could save the Greenback from the third weekly loss in a row.

UK Budget springs few surprises

George Vessey – Lead FX Strategist

The British pound is closing in on fresh 6-week highs against the US dollar in the mid-$1.27 region thanks to a series of weak US data weighing on the US dollar. Elsewhere, the pound remains little changed against the euro, oscillating in a 0.4% range on a daily basis around the €1.17 handle. The UK Budget was a damp squib and UK gilts held fairly steady, given the government’s borrowing plans for the coming financial year came in broadly in line with expectations.

News that the OBR is forecasting UK inflation back at target in a few months briefly sent the pound lower, given the implications for the Bank of England and its future pace and scale of interest rate cuts. Chancellor Jeremy Hunt also implemented a 2p cut in the rates of employees’ and self-employed national insurance contributions, along with another freeze in fuel duty, which accounted for almost all of the net £13.9bn (0.5% of GDP) loosening of fiscal policy in 2024-2025. However, the boost to household spending power from lower headline tax rates still only mitigates around half of the drag from the long-running freeze on income tax and NICs allowances and thresholds. Neither gilts nor sterling showed much reaction overall in the end, which is unsurprising given how heavily the bulk of the measures were trailed in advance.

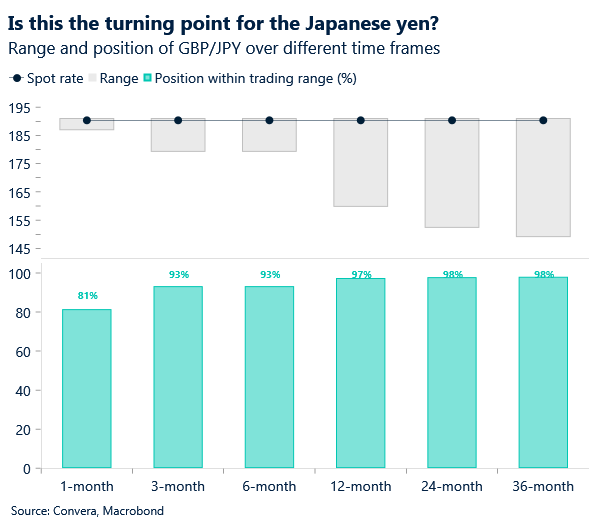

The biggest call out in FX over the last 24 hours is the strength of the Japanese yen on growing speculation that the Bank of Japan (BoJ) could end negative interest rates this month. The yen has weakened considerably over the past two years owing to stark interest rate differentials. Major central banks aggressively raised interest rates to tame inflation, while the BoJ remained a lone outlier with its ultra-easy monetary policy stance. GBP/JPY has fallen about 1.5% since last week’s 2015 high and is on track for its biggest daily decline year-to-date.

Euro rallies to a 6-week high ahead of ECB decision

Ruta Prieskienyte – FX Strategist

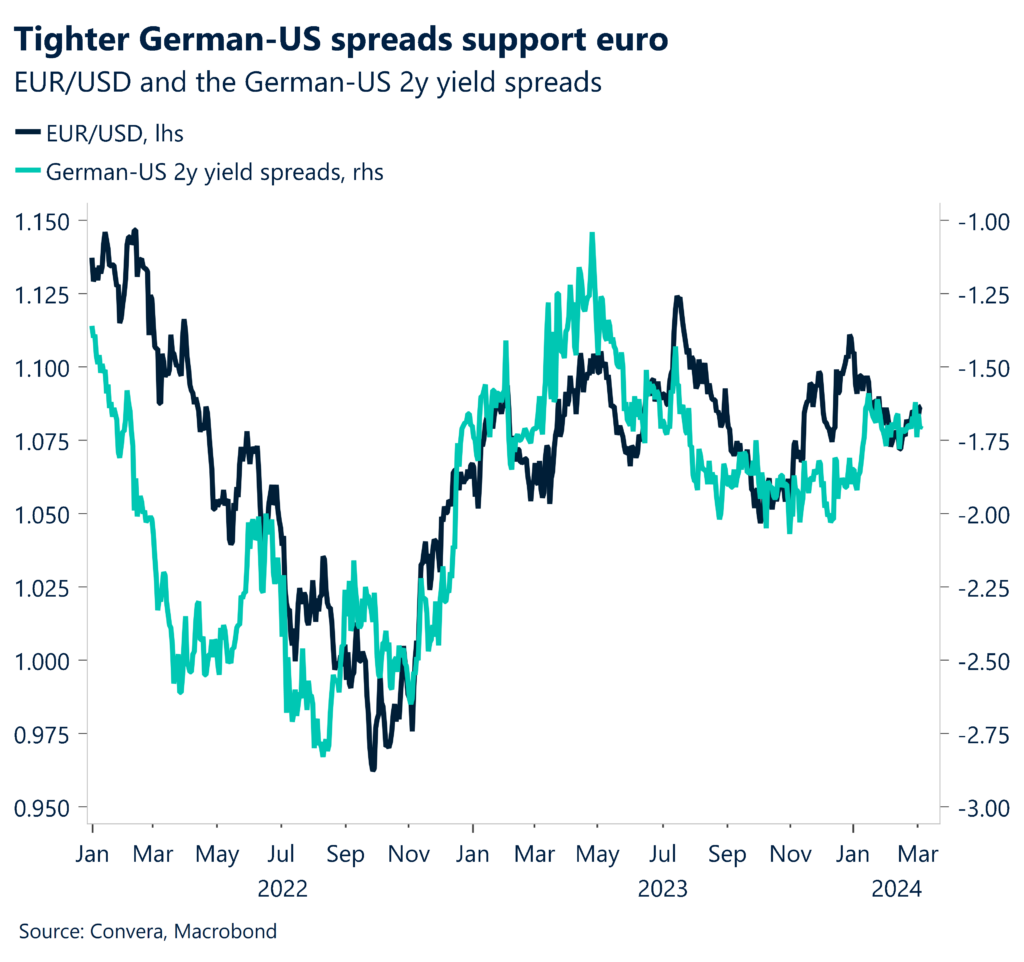

Eurozone stocks advanced and the euro rallied above the 55-DMA towards $1.09 as US dollar sank on weaker US news. With US 10-year Treasury yields turning lower after Powell’s statement, dollar’s yield advantage over the euro eroded further. German-US 2-year spreads, which EUR/USD is correlated with, traded their tightest in four sessions as it neared -166bps, providing support for the common currency.

The latest macro data showed Eurozone retail sales edge up in January, expanding by a meagre 0.1% m/m in January 2024, following a revised contraction in December. While momentum is somewhat promising, on a yearly basis, retail sales fell by 1.0%, marking the 16th consecutive month of contraction. Meanwhile, EUR/USD was supported by an unexpected rise in German trade surplus, which saw the trade balance swell to a record €27.5 billion in January. Such strongly positive data bodes well for the common currency as it marginally lessens the probability of future ECB easing.

Investors now redirect their focus to the ECB’s monetary policy meeting scheduled today, eager for insights into the central bank’s policy outlook. While policymakers are widely expected to maintain interest rates at their current record highs, traders will carefully analyse the updated economic projections and any indications from President Christine Lagarde regarding the timing of potential rate cuts. While ECB is expected to hold policy rates unchanged, even a slight dovish tilt in central bank communication, while not our base case, would be euro negative and could see EUR/USD erase yesterday’s gains and test low $1.08.

CAD at 2-week high as BoC urges caution

Ruta Prieskienyte – FX Strategist

As widely anticipated, the Bank of Canada (BoC) held its target for the overnight rate at 5% for the sixth consecutive time during its March meeting held yesterday. The central bank emphasized the need for further progress in core consumer prices, while headline inflation showed a downward trend. In response, the Canadian dollar rebounded from a 3-month low, rallying below $1.35 mark per US dollar, while CA 10-year government bond yield remained largely unchanged around 3.30% (1-month low).

The BoC has left its policy statement almost unchanged compared to January, defying some expectations that easing references would have been introduced today. During a press conference, Governor Macklem said it was too early to consider lowering rates as more time was needed to ensure inflation fell toward the 2% target. The latest data revealed that CPI inflation eased to 2.9% in January, but year-over-year and three-month measures of core inflation were in the 3% to 3.5% range. Policymakers project inflation to remain close to 3% during the first half of this year before gradually easing. The bank also noted that GDP growth remained weak and below potential, while employment continues to rise more slowly than the population amid signs that wage pressures may be easing. Overall, it is unlikely that the BoC will loosen policy before summer. Money markets are pricing in a 67% probability of a rate cut in June and cumulative 80bps cuts by year end.

We expect USD/CAD to stay rangebound in the short term, sandwiched between 200 DMA (support at $1.3476) and 100 DMA (resistance at $1.3532). We expect US NFPs due tomorrow to inject fresh volatility into the markets, given an otherwise sleepy backdrop, with implied volatility for overnight USD/CAD options shooting up to a near 6-month high of 6.92.

Yen jumps nearly 2% since last week

Table: 7-day currency trends and trading ranges

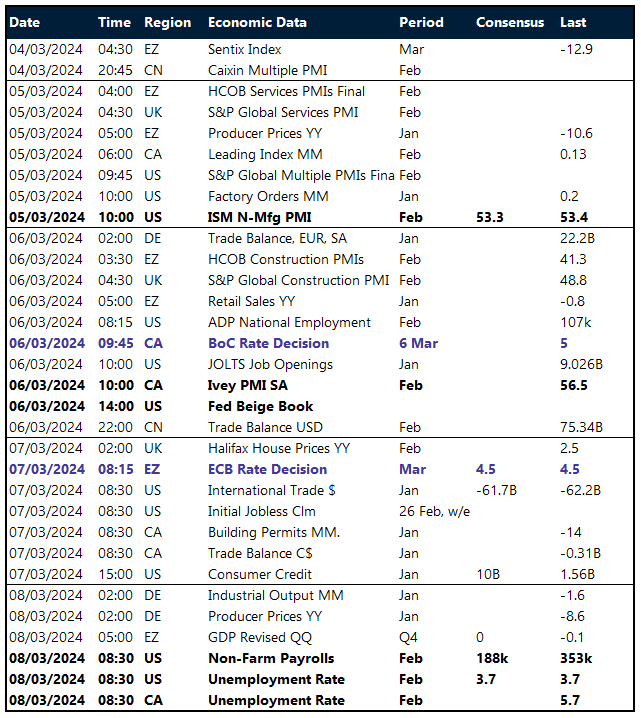

Key global risk events

Calendar: March 4-8

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Join us for Convera Live! A series of in-person events discussing the future of global payments.