The U.S. dollar hovered near mid-February lows as the Federal Reserve kicked off a two-day policy meeting with some market participants split on whether America’s central bank would announce a ninth straight rate hike on Wednesday. The greenback languished near two-week lows versus the Canadian dollar and its weakest in more than a month against the euro and sterling. The recent banking crisis has led markets to rein in expectations for Fed rate increases that are aimed at subduing elevated inflation. While the Fed’s aggressive rate hikes over the past year have put a dent in inflation they also have put a crack in America’s banking sector following a pair of bank failures. Odds favor the Fed announcing a 25 basis point rate hike Wednesday at 2 p.m. ET that, if realized, would lift America’s benchmark lending rate to a range of 4.75% to 5%. No rate hike this week, the minority view, would risk heaping fresh downward pressure on the dollar as it would telegraph a more dovish outlook for policy. For the dollar to catch a break and stabilize, the Fed would need to hike rates and keep the door open to further increases.

Euro climbs to 5-week peak

The euro rolled to five-week highs against its fragile U.S. counterpart. Policy divergence is back in play and supporting the euro after the ECB last week raised rates by hefty 50 basis points to 3%. If the Fed raises rates this week, it’s expected to deliver a second straight quarter point increase, a sharp reversal from weeks ago when markets had anticipated a bigger half-point increase. The euro shrugged off news that Germany’s ZEW survey of investor confidence moderated more than expected to 13 in March from 28.1 in February as Fed uncertainty overshadowed and weighed on the greenback.

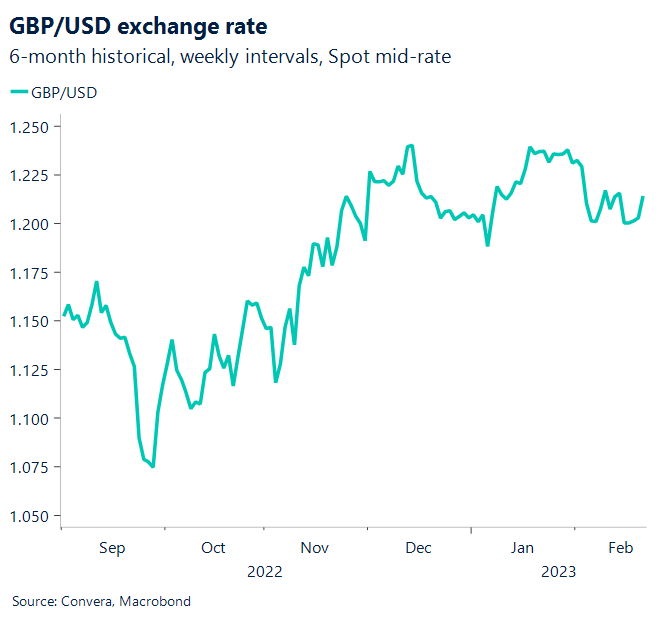

Sterling scales 6-week high

Sterling eased below six-week highs against the U.S. dollar ahead of transatlantic central bank decisions. Rate meetings this week in Washington (Wednesday) and London (Thursday) are somewhat shrouded in uncertainty amid ongoing worries about the health of the global banking sector. Bank concerns, coupled with the fragile shape of the UK economy, could mean that if the Bank of England raises rates to 4.25% from 4%, it could bring central bankers a big step closer to pausing their rapid tightening cycle.

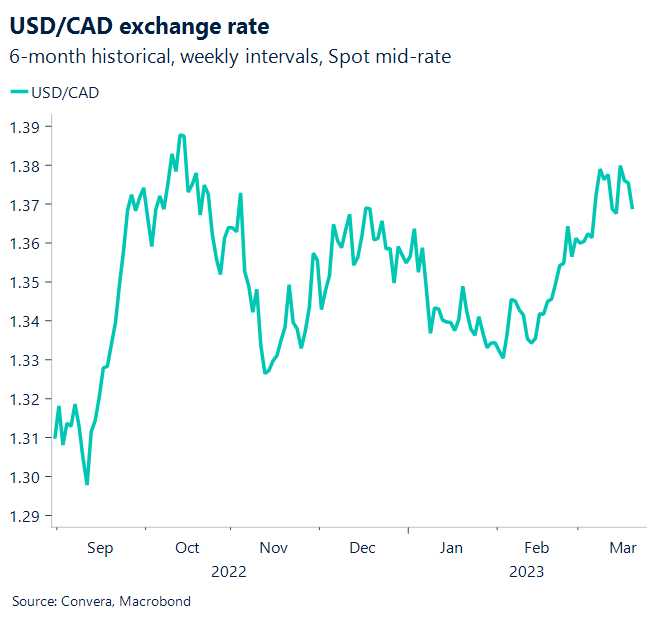

C$ remains hot despite cooler Canadian inflation

Canada’s dollar edged down from two-week highs after cooler than expected domestic inflation offered a vote of confidence in Ottawa’s decision to halt interest rate hikes. Headline Canadian consumer prices cooled to a 5.2% annual pace in February which compared to forecasts of 5.4% from 5.9% in January. Less volatile core inflation also moderated more than expected to 4.7% from 5%. Cooling inflation amid a slowing economy is consistent with the Bank of Canada remaining on the sidelines for at least the first half of 2023.

Dollar turns negative for 2023

Table: rolling 7-day currency trends and trading ranges

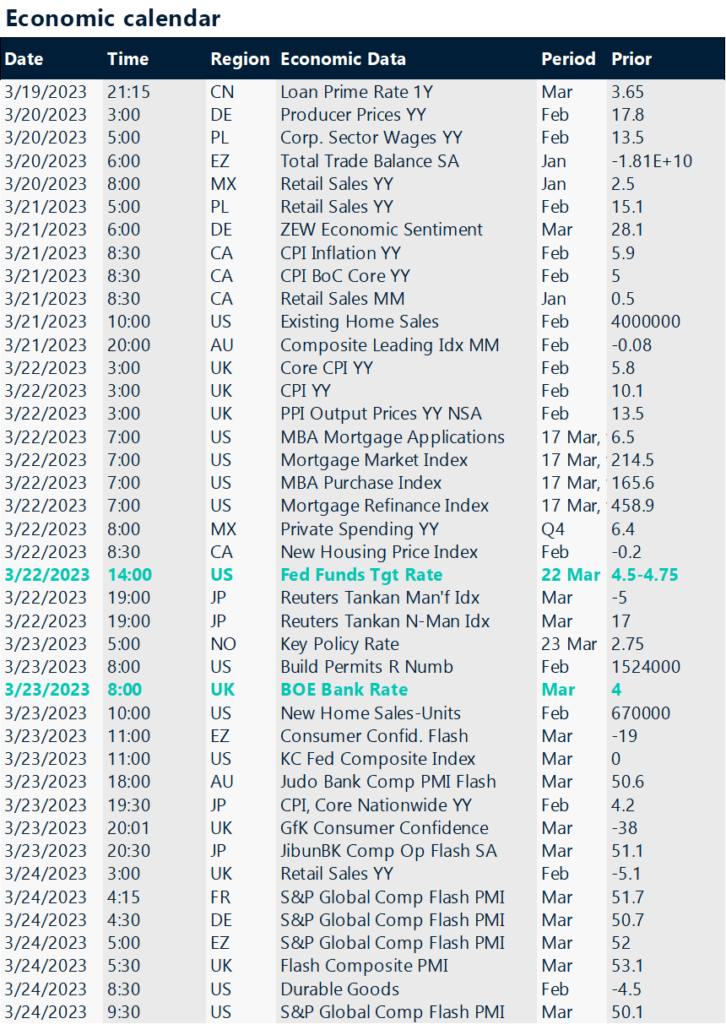

Key global risk events

Calendar: Mar 20-24

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.